KARACHI: After an ordeal spanning many months, the Panama case finally came to a stunning end, bringing with it a sense of direction for stock market participants.

As investors awaited the Supreme Court’s verdict, activity remained subdued until Friday brought the turn of events. The case against former prime minister Nawaz Sharif and his family - an investigation into money-laundering allegations - kept the country in the grip of political instability.

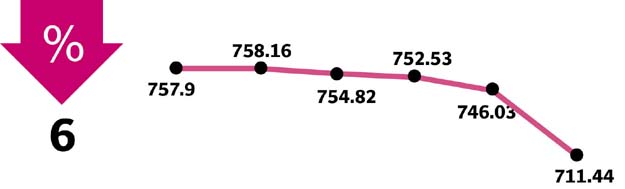

Although the KSE-100 gained 618 points in the outgoing week, the 1.4% increase does not reflect the tumultuous sessions participants had to witness.

Building on gains in the previous session, the stock market began the week on a positive note and cumulatively added 624 points on Monday and Tuesday. However, by mid-week speculation regarding the outcome in the case against the prime minister caused the index to witness slightly volatility, hence Wednesday and Thursday saw minimum activity with the KSE-100 ending on an almost flattish note.

On Friday, before the apex court delivered the verdict on the prime minister’s fate, anxious investors were quick to set the market screens on red mode. The index fell over 1,100 points from the word go but recovered slightly before the verdict. As the bench’s unanimous 5-0 decision disqualified Nawaz Sharif from the seat of PM, the market witnessed choppy trends in the latter half of the day only to remarkably recover from a negative 1,670 points. Opportunists swooped in and bought aggressively, absorbing the selling and paring day’s losses to eventually close the market green by 6 points with $200 million traded.

With this, the index also achieved one of the largest single-day swings as investors had long waited for the uncertainty to vanish.In contrast to the previous week, participation shot up as average trading volumes increased 48% week-on-week to 198 million shares while average traded value rose 36% week-on-week to $97 million.

Activity was focused in retail favourite stocks, which included ANL (86.6 million), TRG (75.8 million), BOP (53.6 million), SSGC (51.2 million) and EPCL (51 million). In terms of sector, major contribution came from food (+10% week-on-week), power (+3.5%), E&Ps (+3.3%), engineering (+3.1%) and chemicals (+2.4%). While, sugar and allied industries (-3%) and cements (-2%) were among the major laggards during the week.

Scrip-wise, oil stocks rallied the most tracking international oil prices, which rose 4.5% week-on-week with OGDC, PPL, POL, cumulatively pulling the index up by a cumulative 154 points, while NESTLE and HUBC contributed further 228.2 points. On the flip side, LUCK, HBL, UBL, MCB, and PSMC cumulatively dragged the benchmark index down by 270 points.

Moreover, positive performance was also posted by oil and gas, power and export-oriented stocks that stood to gain from potential depreciation in PKR; AVN, HUBC, PPL rallied 14%, 6% and 3%, respectively. On the other hand, Fauji Foods (FFL) rallied 15.8% during the week, on the back of announcement of right issue of Rs3.3 billion along with its financial results.

With that said, foreign selling in the week clocked-in at $13.16 million compared to $2.01 million in the previous week. Major foreign selling countersigned in cements ($7.3 million), commercial banks ($3.9 million) and power generation ($2.6 million), however, buying was focused on fertiliser ($3.4 million).

On the domestic front, mutual funds were net sellers of $8.2 million while individuals remained net buyers of $23.7 million.

Among key highlights of the week were; US said that it will not pay Pakistan’s military reimbursements this year, Nepra’s notification for upfront tariff for future Thar coal-based plants, calls by fertiliser industry to issue official notification for subsidy reduction, release of urea sales numbers (+70% YoY), PIB auction received a lukewarm response, and ECC approved fresh sovereign guarantees to clear power sector liabilities.

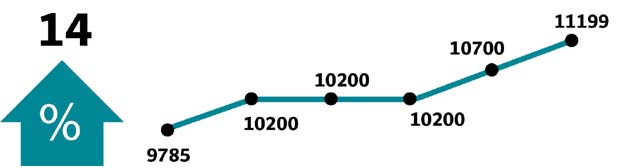

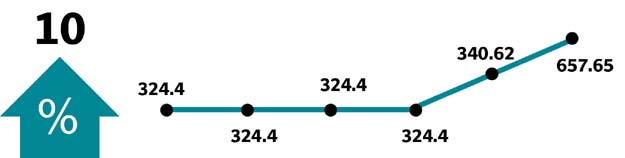

Winners of the week

Nestle Pakistan

Nestle Pakistan Limited manufactures, imports, and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Pakistan International Container Terminal

Pakistan International Container Terminal operates a container shipping facility in Karachi.

International Steel

International Steels Ltd manufactures steel. The company produces cold rolled sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

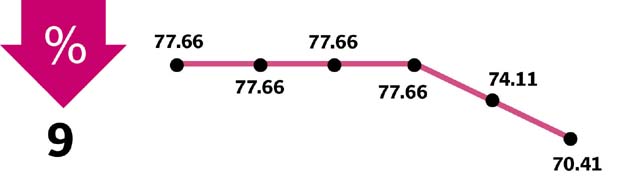

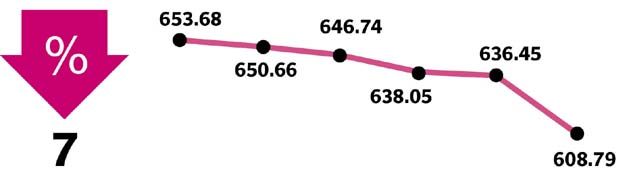

Losers of the week

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd also owns an in-house power generation plant.

Pak Suzuki Motor

Pak Suzuki Motor Company Limited manufactures, assembles, and markets Suzuki cars, pickups, vans and 4X4 vehicles.

Lucky Cement

Lucky Cement Limited manufactures and sells cement. The company’s cement brands include Lucky Gold Brand, Lucky Brand, Lucky Star Brand. Lucky Cement’s main plant site is located at the District Lucky Marwat in the K-P of Pakistan.

Published in The Express Tribune, July 30th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ