Crude oil extended losses during this week trading session, losing $1.67 bp after peeking 48.88 high on Monday. Yesterday, oil rallied $48.18 high bp, but as reports showed that Sharara Libyan output showed signs of recovery, the black gold was on selloff wave pushing prices at $47.35 low, still global supply glut overwhelms.

On the other hand, absence of reports showing any progress between OPEC and Non-OPEC counties with new updates leaves market to deal only with recent events. Although reports shows a decline in the U.S outputs, but fear of global over supply still weighs in market.

Fundamentally, recent reports indicates that U.S Shale outputs would be boosted and increase the moment oil reaches around $50.00 price bp to break even cost production which could give a hint why oil levels fails to over pass the 50 level, and in case target is reached, a significant slip occurs.

Eyes today will be focused on U.S. Crude Inventories report which will be released at 2:30 PM GMT to bring more action for oil levels.

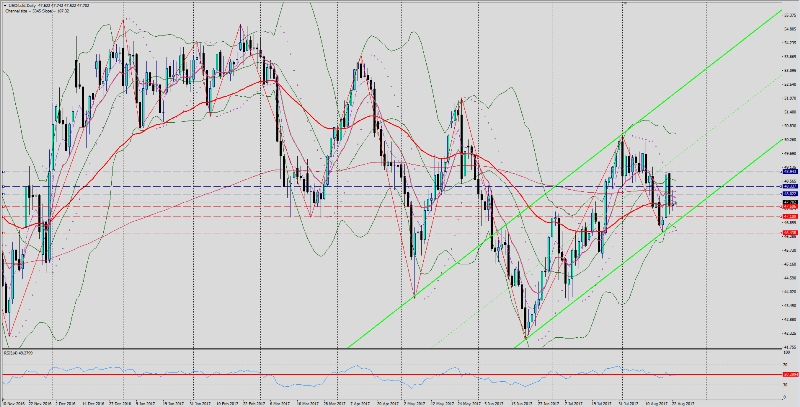

Technical Overview...