Can gold take out the 2019 highs and carry the miners on a mighty bull run that will stun all the naysayers?

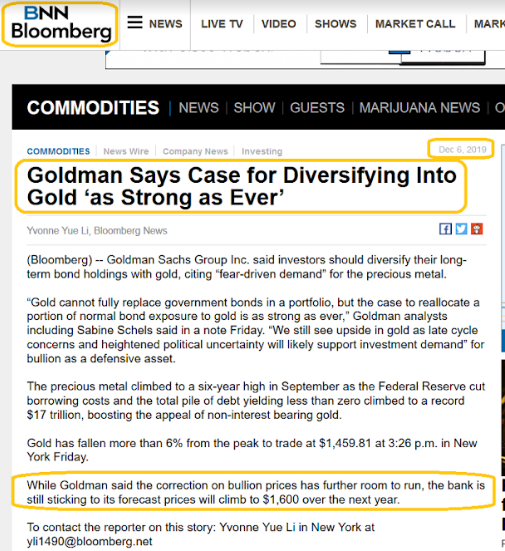

Goldman analysts think it will happen.

Some gold bugs view the big banks as “banksters”. I like to differentiate between the bank algo traders that operate on the COMEX and the fundamental analysts that do meticulous research.

Most bank analysts are very positive on gold price action for 2020 and that’s a good thing.

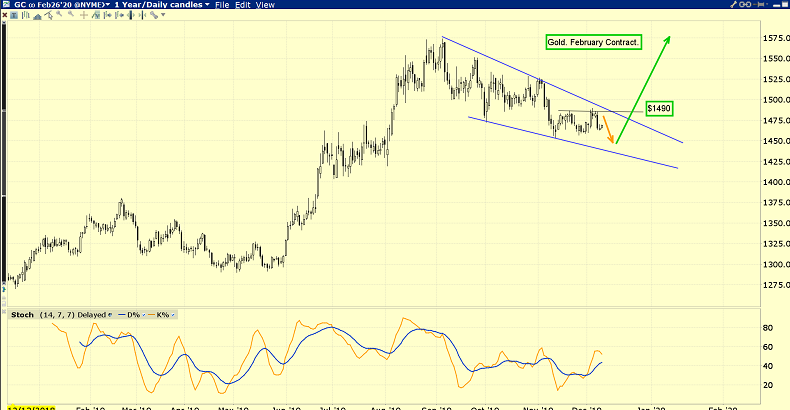

While some more “time in the bull wedge hopper” might be required, there’s no question that the price action during gold’s reaction has been stable.

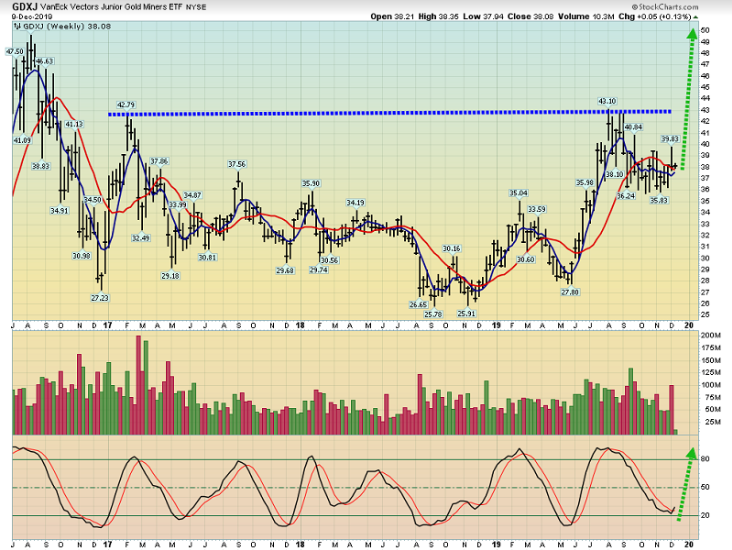

The venture index has built a base against bullion and an upside breakout seems imminent. What’s particularly impressive is that dozens of individual junior miners are already in “rocket mode”, against both gold and the dollar.

Top mine builders like Sean Boyd of Agnico Eagle fame believe 2020 will see a major ramp-up in mergers and takeovers in the industry. That’s because most of the senior players simply cannot grow their own production significantly.

Strong merger and acquisition activity is the sign of a healthy market and is likely the fundamental force that pushes GDXJ over the key $43 resistance zone.

Is the U.S. election a positive driver for gold? Well, most of the democratic candidates want to spend more and borrow more. Like Reagan, Trump promised that his tax cuts would create “Big revenues for the government, and wipe out the deficit.”

In regard to government debt, much like “Reaganomics”, “Trumponomics” has quickly devolved into “Debtonomics”. Debt continues to skyrocket. The bottom line:

Most republicans and democrats alike don’t understand that tax cuts boost the private-sector economy and the reduced government revenues from the tax cuts should incentivize government to cut its size.

Sadly, (or hilariously, depending on perspective) government rarely responds to less revenues by cutting its own size. Instead, it gleefully prints, borrows, and extorts more money for itself.

Trump’s refusal to cut government size as revenues are pressured by tax cuts is clearly great news for gold.

I don’t see anyone in the running for president who is really interested in reducing the debt of the U.S. government, except perhaps for Mike Bloomberg.

While he might cut government debt a bit, Bloomberg is unlikely to cut its size. Also, he is very pro-China in his views. If he wins the election, tariffs likely die quite quickly, China starts a new growth streak, and the citizens there buy a lot more gold.

Here’s the bottom line for gold, right here, right now: No matter who wins the U.S. election, gold is well-supported. A move above $1575 on my gold chart likely ushers in not a bubble or mania as we saw in 2010-2011, but a value-oriented mergers and buyouts frenzy that could continue for years.

Gold mining stock enthusiasts had their upside breakout hopes dashed yet again last week.

From the $28 area, I suggested to subscribers that a sharp pullback to about $26.50 was more likely than a runaway move to the upside.

That’s roughly in play now. There’s an inverse H&S pattern within the bull wedge, which is bullish. Wednesday’s Fed meeting should produce enough volatility to finish forming the right shoulder of the pattern.

A modest stock market sell-off is likely on news, but the Fed obviously stands ready to support the market. The year 2020 is likely to see the U.S. stock market meander sideways-to-higher, government debt should continue to rise, and a major bull cycle in the Chinese stock market should commence. Gold is well-supported in this environment.

I bought the GOAU ETF on the bull wedge breakout, and recommended investors buy down to $15.75.

I would not buy more until there is a two-day close over $16.50, and then traders and gamblers could buy quite aggressively, as a new uptrend would be in play.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.