India Buys US Gold and Silver to Rebalance Trade Under Trump

India to Buy US Gold and Silver to Rebalance US Trade Under Trump

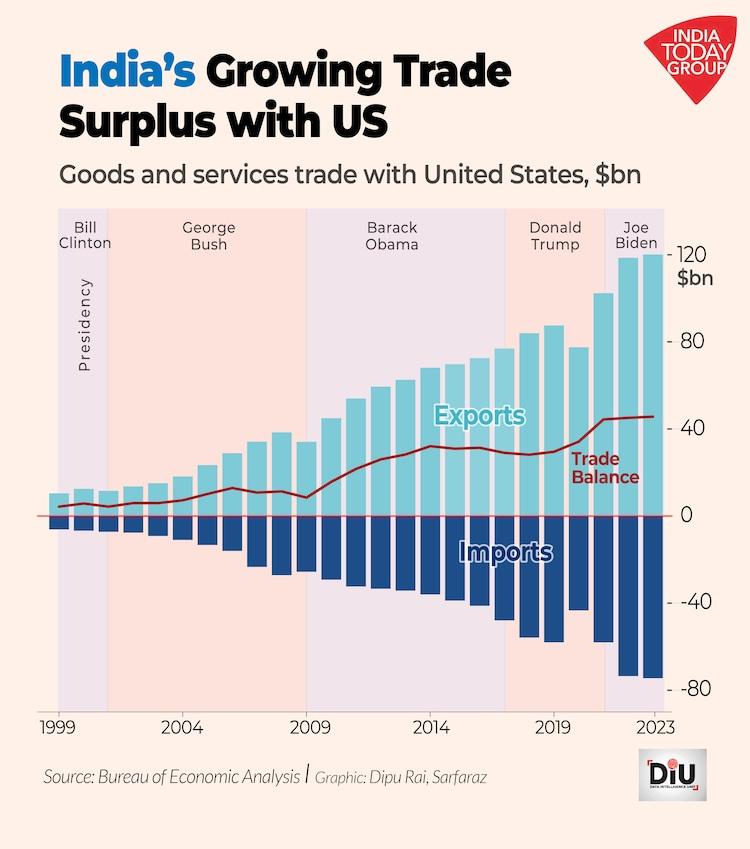

“The U.S. is miffed by the trade deficit, which is one of the key reasons for imposing 26% reciprocal tariffs on India,” one official noted. The BTA is expected to address these concerns by increasing high-value imports from the U.S.

Authored by GoldFix, ZH Edit

India is weighing the import of gold, silver, and other precious metals from the United States as part of a broader strategy to narrow its bilateral trade deficit. says the Hindustan times According to sources familiar with the negotiations, the idea is being explored under the ongoing Bilateral Trade Agreement (BTA) discussions, which aim to integrate supply chains and introduce concessional duties on high-value trade items.

India's Trade Deal Discussion as reported by Hindu-Times with Trump Will include Silver and Gold as Trade items@htTweets pic.twitter.com/9xuTe1v8Ob

— VBL’s Ghost (@Sorenthek) April 15, 2025

“The U.S. is miffed by the trade deficit, which is one of the key reasons for imposing 26% reciprocal tariffs on India,” one official noted. The BTA is expected to address these concerns by increasing high-value imports from the U.S.

In addition to oil, India is looking at precious metals and finished jewellery as trade diversifiers. Officials believe these items represent “low-hanging fruit” in the larger effort to rebalance trade while reducing exposure to politically motivated tariff regimes.

On Wednesday, the spokesperson for India’s Ministry of External Affairs confirmed that both countries are actively negotiating a trade agreement. “We hope to address outstanding issues and conclude this agreement expeditiously,” said Randhir Jaiswal.

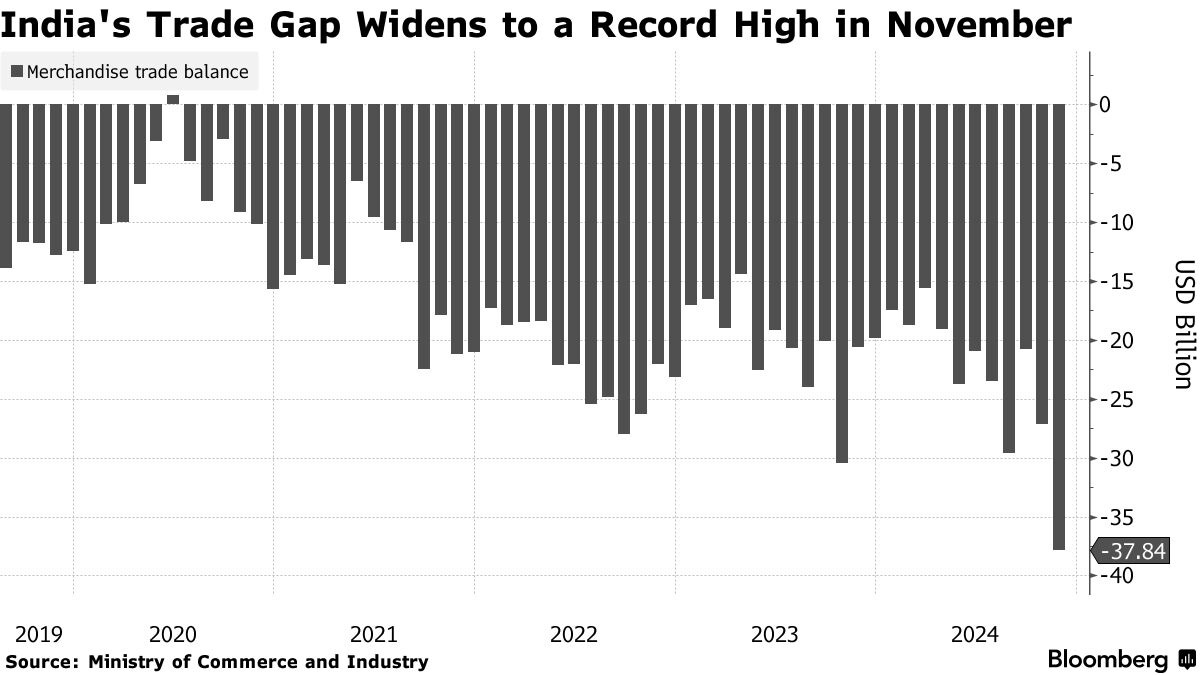

Trade Imbalance and the Push for Diversification

During April 2024 to February 2025, India exported goods worth $76.37 billion to the U.S., while importing $41.62 billion, resulting in a $34.75 billion trade deficit. The situation gained urgency this week as reciprocal U.S. tariffs—imposed by President Donald Trump—officially came into force. While their full impact is still being assessed, India remains hopeful that a successfully negotiated BTA will mitigate further disruptions.

In February 2025, Prime Minister Narendra Modi and President Trump pledged to deepen bilateral trade, targeting a fivefold increase in volume—from $200 billion to $500 billion by 2030. As part of “Mission 500,” both leaders committed to finalizing the BTA by Fall 2025.

“Both sides are deeply engaged to fast-track a mutually beneficial BTA at the earliest,” said one source involved in the negotiations.

Gold, Silver, and Oil: Strategic Commodities

Indian refiners have already ramped up imports of U.S. crude oil, which remains a central pillar of the trade diversification plan. However, policymakers view precious metals as more advantageous due to ease of transportation and lower logistical costs compared to bulk commodities like oil.

India currently imports over 87% of its crude oil, totaling $124 billion during April 2024–February 2025. The U.S. has become a key supplier, joining the ranks of Russia, Iraq, Saudi Arabia, and the UAE. Crude imports from the U.S. surged to 357,000 barrels per day in February 2025, up from 70,600 bpd in December 2024.

Historical trade data from the U.S. Energy Information Administration reveals a dramatic rise in American crude exports to India during the Trump administration, peaking at 21.5 million barrels in December 2021. Exports subsequently dropped to 2.88 million barrels by the end of 2023.

The underlying strategy is dual-purpose: to dilute OPEC’s pricing power and moderate global energy inflation while addressing trade imbalances with the U.S.

Beyond Oil and Metals

India is also exploring additional high-value U.S. imports such as almonds and American whiskey, as part of a broader BTA framework. According to government officials, these categories offer both symbolic and practical benefits in reducing political friction around trade.

“From the Indian perspective, actually working out something bilaterally with the U.S. is not at all a negative… On the contrary, it is something which has long been our objective,” External Affairs Minister S. Jaishankar said during a recent conference.

Structural Outlook

The Indian government is attempting to build redundancy into its global supply networks. At the same time, sourcing monetizable, high-value goods like precious metals from the U.S. complements efforts to hedge against external shocks, reduce trade deficits, and demonstrate diplomatic goodwill.

The stakes are high. With reciprocal tariffs in play and political pressure building on both sides, precious metals now occupy a central role in a recalibrated India–U.S. economic relationship. The success of the BTA will likely hinge not just on concessions, but on the clarity and trust between both parties over the next several months.

Premium: Implications— From World Leader to Ripe for Looting

The US is going to outsource everything in manufacturing that is not entirely a specialty. We just can't compete without destroying our own standard of living.

Number One India seeks to rebalance trade by buying US goods. The only US good it's interested in is a commodity. This implies that we don't make anything they want to buy.

Continues here

Free Posts To Your Mailbox