Key Highlights

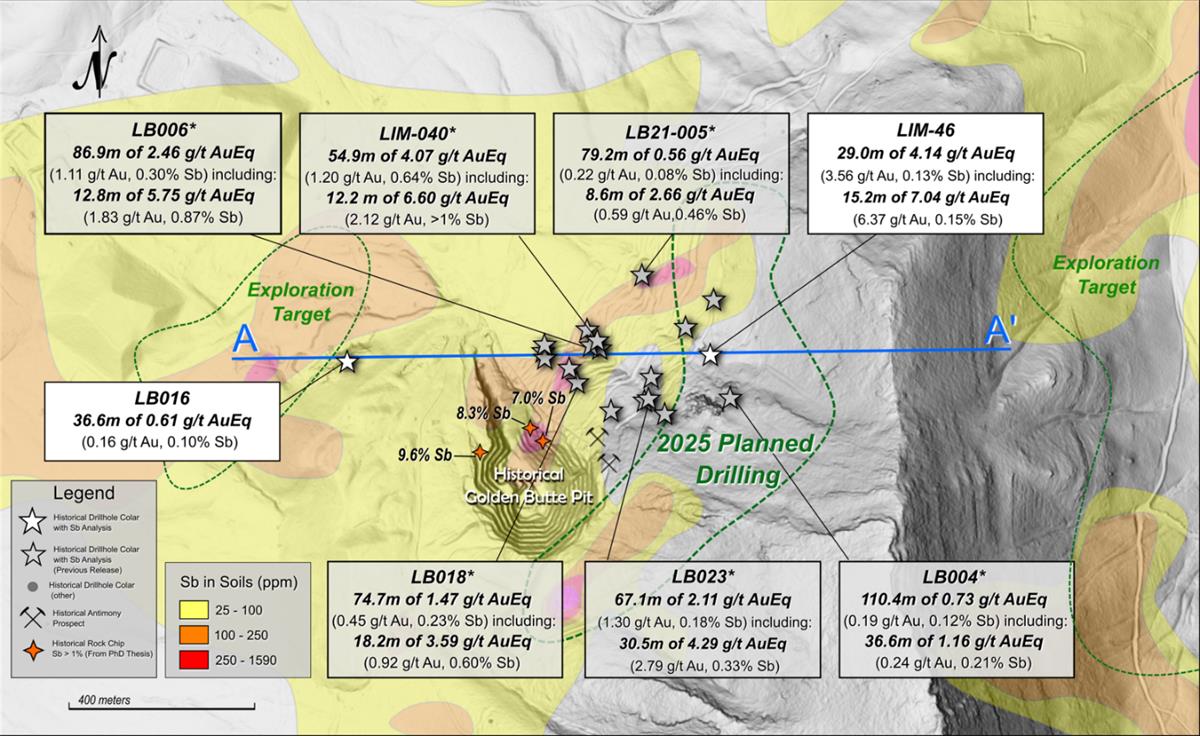

- Some of the highest gold-antimony grades seen to date at Resurrection Ridge including:

- LIM-46: 7.04 g/t AuEq* over 15.2 meters (6.37 g/t Au and 0.15% Sb), within 4.14 g/t AuEq* over 29.0 meters (3.56 g/t Au and 0.13% Sb

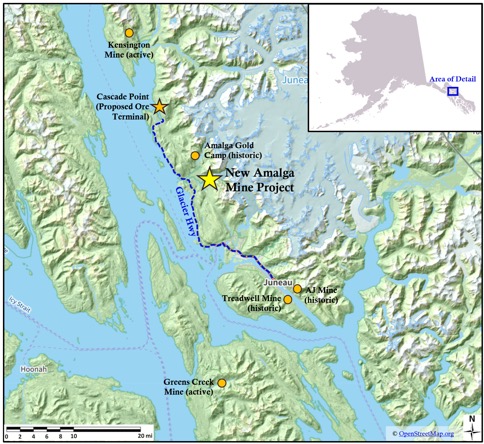

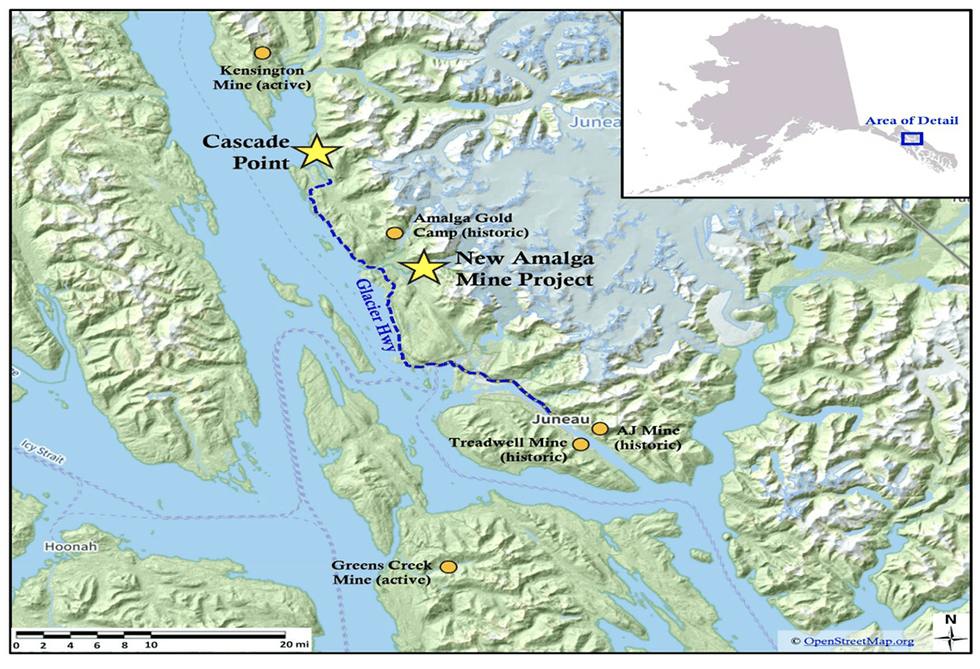

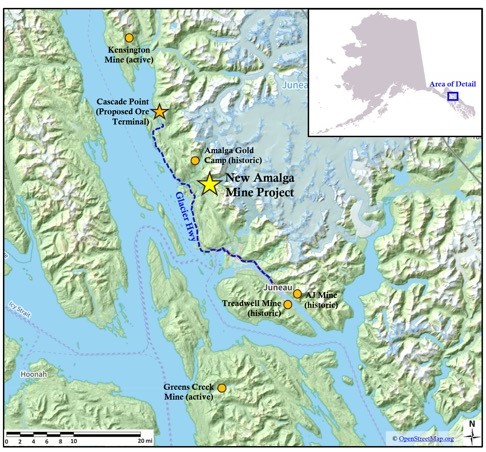

- LB016: 0.61 g/t AuEq* over 36.6 meters from surface (0.16 g/t Au and 0.10% Sb) extending mineralization over 400 meters along strike and opening up large, undrilled areas of the Project for further expansion; the mineralization footprint now expands over 800 meters at Resurrection Ridge (see Figure 1, Figure 2) within a larger +5 km strike length between Resurrection Ridge and Cadillac Valley (Figure 3)

- *Gold equivalents ("AuEq") are based on assumed metals prices of US$2,000/oz of gold and US$35,000 per tonne of antimony (~30% discount to current spot prices), and assumed metals recoveries of 85% for gold and 70% for antimony.

- Drillholes at Resurrection Ridge are drilled with spacing showing strong potential to advance the Project to an initial gold-antimony Mineral Resource Estimate ("MRE") (see Figure 1)

- Over 20 holes have been released to date; the Company has more than 30 holes with pending results from Resurrection Ridge and Cadillac Valley

- Metallurgical testwork program has commenced with over 100 kg bulk sample from the Project and NevGold core drilling; results are expected over the coming weeks

- Resurrection Ridge and Cadillac Valley oxide gold-antimony mineralization demonstrates the significant oxide gold-antimony potential across a large, open mineralized footprint (Figure 1, Figure 4)

- Significant antimony (Sb) upside: historical drilling had an upper detection limit of 1% Sb but drill intervals exceeded the limit ; these samples are currently being re-assayed at American Assay Lab in Reno, Nevada

- NevGold will continue re-evaluating historical drilling from the Project, focusing on both oxide gold and antimony

Limo Butte Planned 2025 Activities / Status Update

NevGold will continue its active exploration program at Limo Butte including:

- Evaluate the historical geological database with focus on gold and antimony (in progress) ;

- Re-analyze historical drilling with focus on gold and antimony (in progress) ;

- Metallurgical testwork (in progress) ;

- Drill test gold-antimony targets (in planning phase) .

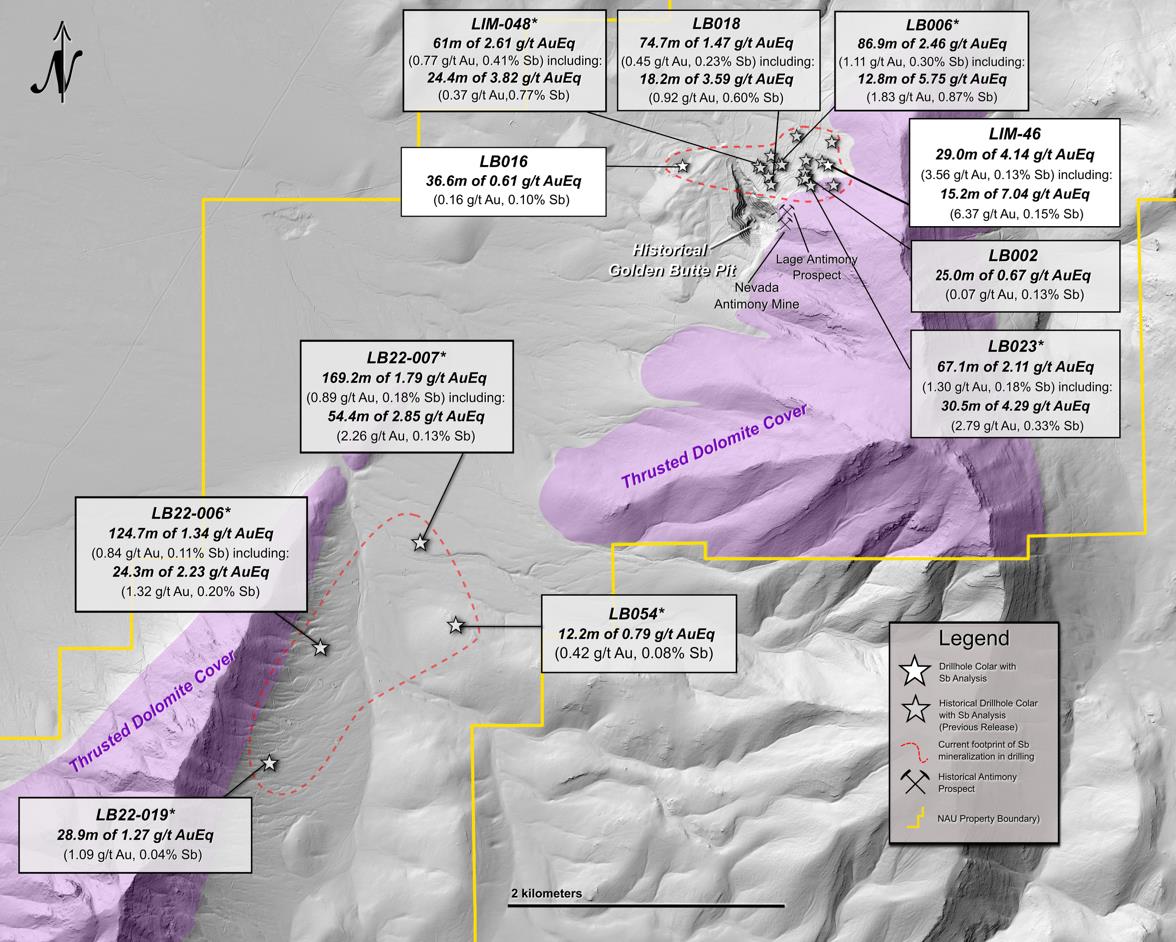

Figure 1 – Limousine Butte Gold-Antimony Project with selected gold-antimony drillhole results.

To view image please click here

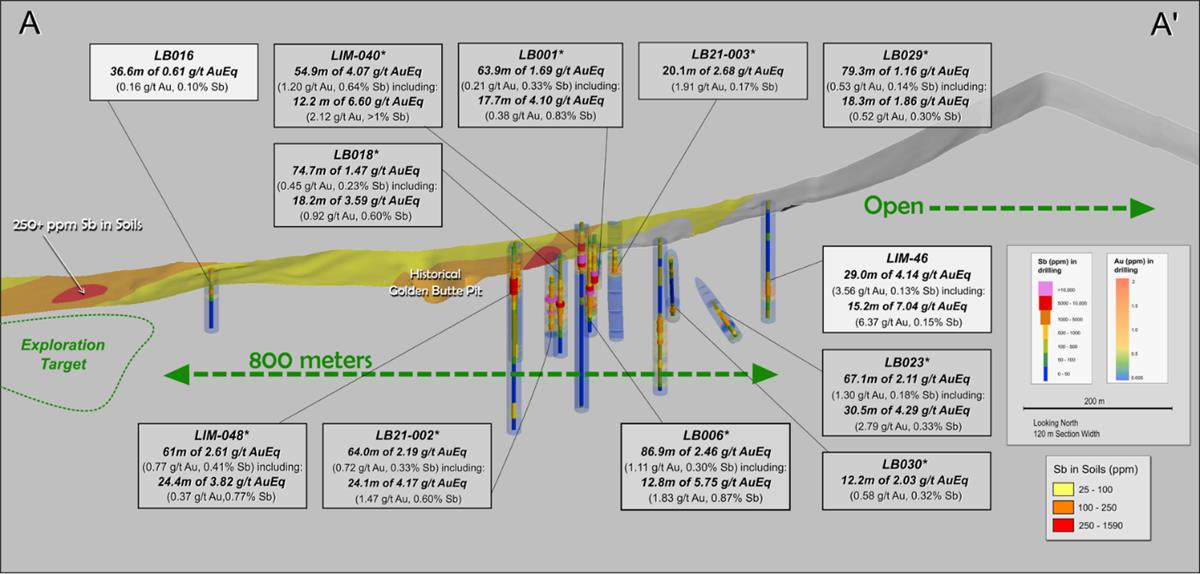

Figure 2 – Limousine Butte Gold-Antimony Project cross-section with selected gold-antimony drillhole results. Thin colored discs show Antimony (Sb ppm) in drilling, and wide colored discs show Gold (Au ppm) in drilling.

To view image please click here

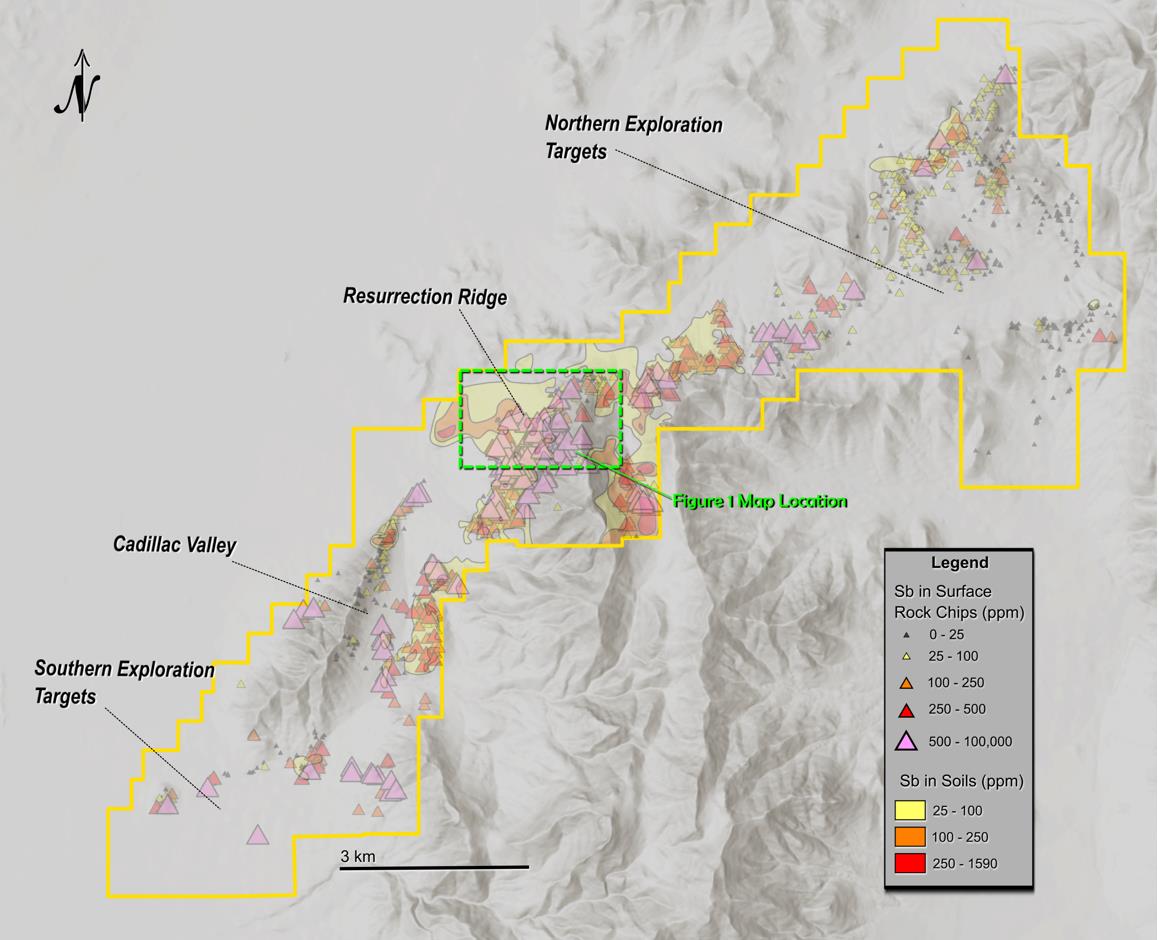

Figure 3 – Limousine Butte Gold-Antimony Project with selected gold-antimony drillhole results at Resurrection Ridge and Cadillac Valley. The total strike length between Resurrection Ridge and Cadillac Valley is +5km.

To view image please click here

NevGold CEO, Brandon Bonifacio, comments: "These results have some of the highest oxide gold-antimony grades that we have seen to date at Limo Butte. We have also started to expand the mineralization footprint at Resurrection Ridge, with over 800 meters defined, and we still have over 30 holes to release prior to commencing our 2025 drill program. We are continuing to see exceptional oxide gold-antimony results across a large area at the Project, and we will remain focused on adding to the mineralization footprint and filling in some of the gaps in the gold-antimony geological database, with the goal of rapidly advancing Limo Butte to an initial gold-antimony Mineral Resource Estimate ("MRE") in 2025 . Our metallurgical testwork program continues to advance to outline the optimal flowsheet to recover the gold and antimony, and we are expecting results over the coming weeks. The environment is optimal to continue to advance and unlock the gold-antimony potential at Limo Butte as there is a clear commitment from the United States to advance high-quality, domestic, mineral projects ."

Historical and Re-Assayed Drill Results

| Hole ID | Length, m* | g/t Au | % Sb | g/t AuEq** | From, m | To, m |

| Resurrection Ridge |

| LIM-46 | 29.0 | 3.56 | 0.13% | 4.14 | 120.4 | 149.4 |

| including | 15.2 | 6.37 | 0.15% | 7.04 | 126.5 | 141.7 |

| LB016 | 36.6 | 0.16 | 0.10% | 0.61 | 0 | 36.6 |

| LB018*** | 74.7 | 0.45 | 0.23% | 1.47 | 36.6 | 111.3 |

| including | 18.2 | 0.92 | 0.60% | 3.59 | 73.2 | 91.4 |

| also including | 6.0 | 0.31 | 0.96% | 4.61 | 73.2 | 79.2 |

| LB030*** | 12.2 | 0.58 | 0.32% | 2.03 | 170.7 | 182.9 |

| LB002*** | 25.0 | 0.07 | 0.13% | 0.67 | 0.0 | 25.0 |

| LB21-002*** | 64.0 | 0.72 | 0.33% | 2.19 | 48.2 | 112.2 |

| including | 24.1 | 1.47 | 0.60% | 4.17 | 50.6 | 74.7 |

| also including | 4.5 | 1.43 | 2.10% | 10.86 | 67.4 | 71.9 |

| LB21-003*** | 20.1 | 1.91 | 0.17% | 2.68 | 62.5 | 82.6 |

| LB024*** | 61.0 | 0.26 | 0.18% | 1.07 | 79.3 | 140.2 |

| LB023*** | 67.1 | 1.30 | 0.18% | 2.11 | 24.4 | 91.5 |

| including | 30.5 | 2.79 | 0.33% | 4.29 | 30.5 | 61.0 |

| also including | 16.8 | 5.05 | 0.46% | 7.12 | 42.7 | 59.4 |

| LB029*** | 79.3 | 0.53 | 0.14% | 1.16 | 122.0 | 201.2 |

| including | 18.3 | 0.52 | 0.30% | 1.86 | 128.0 | 146.3 |

| LB013*** | 49.7 | 0.15 | 0.26% | 1.29 | 30.8 | 80.5 |

| LB21-005*** | 79.2 | 0.22 | 0.08% | 0.56 | 64.5 | 143.7 |

| including | 8.6 | 0.59 | 0.46% | 2.66 | 65.5 | 74.1 |

| LB006*** | 86.9 | 1.11 | 0.30% | 2.46 | 36.6 | 123.4 |

| including | 12.8 | 1.83 | 0.87% | 5.75 | 79.2 | 92.0 |

| also including | 6.7 | 2.29 | +1%**** | 6.77 | 85.3 | 92.0 |

| LB001*** | 63.9 | 0.21 | 0.33% | 1.69 | 13.1 | 77.0 |

| including | 17.7 | 0.38 | 0.83% | 4.10 | 55.2 | 72.8 |

| also including | 6.4 | 0.16 | +1%**** | 4.64 | 55.2 | 61.6 |

| LB003*** | 22.3 | 2.26 | 0.32% | 3.69 | 67.1 | 89.3 |

| including | 7.9 | 5.97 | 0.57% | 8.55 | 81.4 | 89.3 |

| LB004*** | 110.4 | 0.19 | 0.12% | 0.73 | 0.0 | 110.4 |

| including | 36.6 | 0.24 | 0.21% | 1.16 | 6.7 | 43.3 |

| LIM-40*** | 54.9 | 1.20 | 0.64% | 4.07 | 18.3 | 73.2 |

| including | 12.2 | 2.12 | +1%**** | 6.60 | 48.8 | 61.0 |

| LIM-45*** | 36.6 | 1.23 | 0.40% | 3.02 | 24.4 | 61.0 |

| including | 12.2 | 0.35 | +1%**** | 4.83 | 36.6 | 48.8 |

| LIM-48*** | 61.0 | 0.77 | 0.41% | 2.61 | 24.4 | 85.4 |

| including | 24.4 | 0.37 | 0.77% | 3.82 | 48.8 | 73.2 |

| Hole ID | Length, m* | g/t Au | % Sb | g/t AuEq** | From, m | To, m |

| Cadillac Valley |

| LB22-007*** | 169.2 | 0.89 | 0.18% | 1.70 | 213.5 | 382.7 |

| including | 54.4 | 2.26 | 0.13% | 2.85 | 213.5 | 267.9 |

| also including | 3.10 | 0.76 | 2.76% | 13.15 | 259.2 | 267.9 |

| LB22-006*** | 124.7 | 0.84 | 0.11% | 1.34 | 127.4 | 252.1 |

| including | 24.3 | 1.32 | 0.20% | 2.23 | 160.6 | 184.9 |

| LB22-019*** | 28.9 | 1.09 | 0.04% | 1.27 | 170.7 | 199.6 |

| LB054*** | 12.2 | 0.42 | 0.08% | 0.79 | 12.2 | 24.4 |

*Downhole thickness reported; true width varies depending on drill hole dip and is approximately 70% to 90% of downhole thickness.

**The gold equivalents ("AuEq") are based on assumed metals prices of US$2,000/oz of gold and US$35,000 per tonne of antimony (~30% discount to current spot prices), and assumed metals recoveries of 85% for gold and 70% for antimony.

***Selected drillholes released in previous News Releases on February 27, 2025, March 26, 2025, April 10, 2025, April 24, 2025, May 13, 2025, and June 3, 2025.

**** Historical drilling had an upper detection limit of 1% Sb but many drill intervals exceeded the limit.

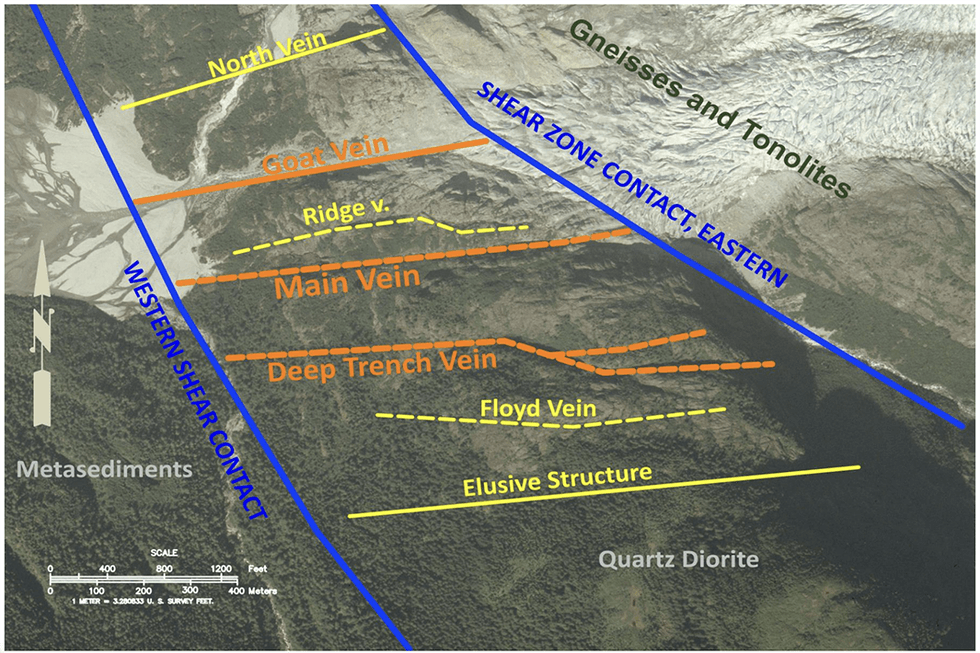

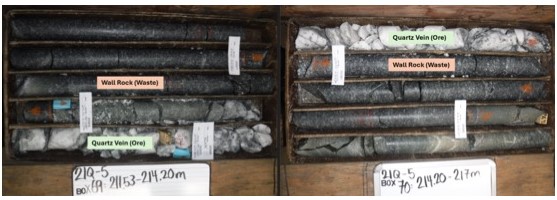

Limo Butte Geology & Antimony Summary

A review of historical geochemical and drilling data at the Limousine Butte Project has identified multiple areas with strong gold-antimony potential. These zones correlate closely with outcrops of the Devonian Pilot Shale, the primary host rock for Carlin-type gold mineralization in the area. Positive gold grade at Limousine Butte is typically associated with silicification and the formation of jasperoid breccias within the Pilot Shale, an alteration feature also observed in the positive antimony results.

Through the Project data review, the Company uncovered reports detailing two small-scale historic mining operations at the Nevada Antimony Mine and Lage Antimony Prospect within the Limo Butte Project boundary. The Nevada Antimony Mine featured two prospect pits that extracted stibnite (formula: Sb 2 S 3 ) from a hydrothermal breccia. The Lage Antimony Prospect reported historical unverified sampling results with up to 14.46% Antimony with additional prospect pits extracting antimony.

Historical geochemical rock chip sampling within the past-producing Golden Butte pit from a Brigham Young University ("BYU") Thesis study produced numerous results that exceeded 1% antimony in jasperoid breccias (see Figure 1). Several results were greater than 5% antimony, including a sample of 9.6% antimony with visible stibnite and stibiconite . BYU Thesis Report

NevGold VP Exploration, Greg French, comments: "These results are some of the strongest gold-antimony grades seen at the Project. It is also encouraging to see the mineralization extend along strike to the south where there is little antimony assay drill data, and to the north where there is minimal historical drilling. With our robust understanding of the structures and key mineralization host rocks, these areas will be a focus of our 2025 drilling as we look to expand the oxide gold-antimony mineralization footprint along strike . We are excited to commence our 2025 drill program shortly which will be focused on strengthening our current gold-antimony geological database , along with making new gold-antimony discoveries. "

Figure 4 – Limousine Butte Project with historical antimony in rock chips and soils. The total strike length between Resurrection Ridge and Cadillac Valley is +5km. To view image please click here

US Executive Order – Announced March 20, 2025

The Company is pleased to report the recent, sweeping Executive Order to strengthen American mineral production and reduce U.S. reliance on foreign nations for its mineral supply . Antimony (Sb) has been identified as an important "Critical Mineral" in the United States essential for national security, clean energy, and technology applications, yet no domestically mined supply currently exists.

The Executive Order invokes the use of the Defense Production Act as part of a broad United States ("US") Government effort to expand domestic minerals production on national security grounds. As it relates to project permitting, the Order states that it will "identify priority projects that can be immediately approved or for which permits can be immediately issued, and take all necessary or appropriate actions…to expedite and issue the relevant permits or approvals." Furthermore, the Order includes provisions to accelerate access to private and public capital for domestic projects, including the creation of a "dedicated mineral and mineral production fund for domestic investments" under the Development Finance Corporation ("DFC").

This decisive action by the US Government highlights the urgent need to expand domestic minerals output to support supply chain security in the United States. This important Order will help revitalize domestic mineral production by improving the permitting process and providing financial support to qualifying domestic projects.

Importance of Antimony

Antimony is considered a "Critical Mineral" by the United States based on the U.S. Geological Survey's 2022 list (U.S.G.S. (2022)). "Critical Minerals" are metals and non-metals essential to the economy and national security. Antimony is utilized in all manners of military applications, including the manufacturing of armor piercing bullets, night vision goggles, infrared sensors, precision optics, laser sighting, explosive formulations, hardened lead for bullets and shrapnel, ammunition primers, tracer ammunition, nuclear weapons and production, tritium production, flares, military clothing, and communication equipment. Other uses include technology (semi-conductors, circuit boards, electric switches, fluorescent lighting, high quality clear glass and lithium-ion batteries) and clean-energy storage.

Globally, approximately 90% of the world's current antimony supply is produced by China, Russia, and Tajikistan. Beginning on September 15, 2024, China, which is responsible for nearly half of all global mined antimony output and dominates global refinement and processing, announced that it will restrict antimony exports. In December-2024, China explicitly restricted antimony exports to the United States citing its dual military and civilian uses, which further exacerbated global supply chain concerns. (Lv, A. and Munroe, T. (2024)) The U.S. Department of Defense ("DOD") has designated antimony as a "Critical Mineral" due to its importance in national security, and governments are now prioritizing domestic production to mitigate supply chain disruptions. Projects exploring antimony sources in North America play a key role in addressing these challenges.

Perpetua Resources Corp. ("Perpetua", NASDAQ:PPTA, TSX:PPTA) has the most advanced domestic gold-antimony project in the United States. Perpetua's project, known as Stibnite, is located in Idaho approximately 130 km northeast of NevGold's Nutmeg Mountain and Zeus projects. Positive advancements at Stibnite including the technical development and permitting has led to US$75 million in Department of Defense ("DOD") awards, and over $1.8 billion in indicative financing from the Export Import Bank of the United States ("US EXIM") ( see Perpetua Resources News Release from April 8, 2024 ) (Perpetua Resources. (2025))

Drillhole Orientation Details

| Hole ID | Target Zone | Easting | Northing | Elevation (m) | Length (m) | Azimuth | Dip |

| LIM-46 | RR | 667271 | 4417374 | 2187 | 182.9 | 0 | -90 |

| LIM016 | RR | 666518 | 4417359 | 2073 | 91 | 0 | -90 |

| LB018 | RR | 666993 | 4417308 | 2132 | 152.4 | 0 | -90 |

| LB030 | RR | 667143 | 4417273 | 2174 | 193.5 | 0 | -60 |

| LB002 | RR | 667177 | 4417244 | 2192 | 182.9 | 82 | -50 |

| LB21-002 | RR | 666979 | 4417343 | 2117 | 151.8 | 0 | 90 |

| LB21-003 | RR | 667061 | 4417417 | 2129 | 183.5 | 0 | 90 |

| LB024 | RR | 667217 | 4417423 | 2159 | 189 | 70 | -80 |

| LB023 | RR | 667143 | 4417273 | 2174 | 187 | 70 | -60 |

| LB029 | RR | 667128 | 4417307 | 2162 | 237.7 | 0 | -90 |

| LB013 | RR | 667142 | 4417273 | 2177 | 164.7 | 90 | -50 |

| LB21-005 | RR | 667279 | 4417487 | 2179 | 253.8 | 0 | -90 |

| LB006 | RR | 667030 | 4417384 | 2125 | 152.7 | 0 | -90 |

| LB001 | RR | 667036 | 4417384 | 2125 | 77 | 0 | -90 |

| LB003 | RR | 667134 | 4417528 | 2133 | 129.4 | 0 | -90 |

| LB004 | RR | 667313 | 4417277 | 2239 | 198.7 | 270 | -50 |

| LIM-40 | RR | 667018 | 4417409 | 2124 | 289.6 | 0 | -90 |

| LIM-45 | RR | 666929 | 4417389 | 2103 | 179.8 | 0 | -90 |

| LIM-48 | RR | 666927 | 4417374 | 2105 | 286.5 | 0 | -90 |

| LB22-007 | CV | 665211 | 4415453 | 2031 | 403.5 | 254 | -86 |

| LB22-006 | CV | 664692 | 4414921 | 2042 | 379.8 | 144 | -77 |

| LB22-019 | CV | 664433 | 4414318 | 2096 | 335.3 | 116 | -66 |

| LB054 | CV | 665323 | 4415090 | 2059 | 157.0 | 0 | -90 |

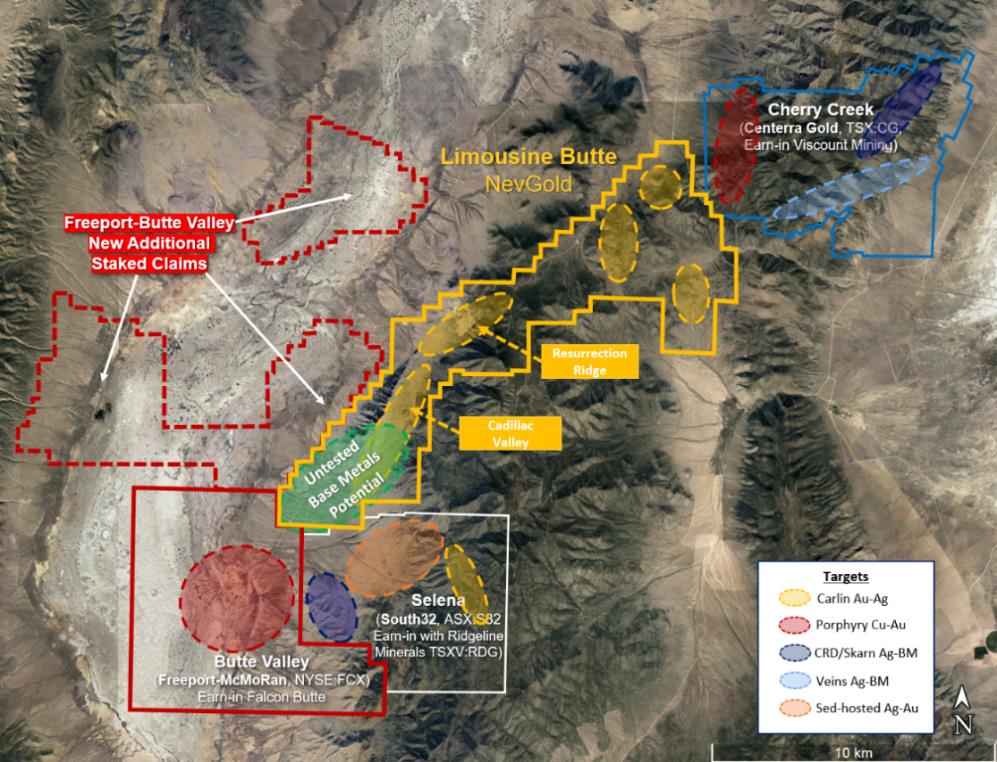

Figure 5 – Limousine Butte Land Holdings and District Exploration Activity To view image please click here

Engagement of Marketing Consultants

The Company has retained Machai Capital Inc. ("Machai Capital"), based in Vancouver, Canada, to provide marketing services including advertising, press release distribution, native advertising of editorial, and additional services as may be determined. Machai Capital will utilize its expertise in branding, content and data optimization, search engine optimization, search engine marketing, lead generation, digital marketing, social media marketing, email marketing, and brand marketing to enhance the Company's marketing campaigns and increase awareness of the Company. The program is budgeted for C$350,000 over a two-month term starting on June 1, 2025. Machai Capital and its principals have an arm's length relationship with the Company. Machai Capital currently owns 50,000 shares of the Company.

The Company has also retained Equedia Network Corporation ("Equedia Network"), based in Vancouver, Canada, to provide advertising, press release distribution, native advertising of editorial, and additional services as may be determined. The program will utilize non-generic marketing channels to provide the Company exposure to fresh investment audiences. The advertising program is budgeted for C$150,000 over a six-month term starting on June 1, 2025. Equedia Network and its principals have an arm's length relationship with the Company.

Additionally, NevGold announces that it has entered into a digital marketing services agreement with Altura Media Co Inc. ("Altura"), who is based in British Columbia, for an initial three-month period expected to commence on June 9, 2025. Under the agreement, Altura will provide a comprehensive suite of services, including digital advertising, media creation, social media marketing and shareholder communications. In consideration of its services, the Company will pay Altura Media a fee of up to C$150,000. Altura and its principals have an arm's length relationship with the Company.

ON BEHALF OF THE BOARD

"Signed"

Brandon Bonifacio, President & CEO

For further information, please contact Brandon Bonifacio at bbonifacio@nev-gold.com, call 604-337-4997, or visit our website at www.nev-gold.com .

Historical Data Validation

NevGold QA/QC protocols are followed on the Project and include insertion of duplicate, blank and standard samples in all drill holes. A 30g gold fire assay and multi-elemental analysis ICP-OES method was completed by ISO 17025 certified American Assay Labs, Reno.

The Company's Qualified Person ("QP"), Greg French, Vice President, Exploration has completed a review of the historical data in this press release. The historic data collection chain of custody procedures and analytical results by previous operators appear adequate and were completed to industry standard practices. For the Newmont and US Gold data a 30g gold fire assay and multi-elemental analysis ICP-OES method MS-41 was completed by ISO 17025 certified ALS Chemex, Reno or Elko Nevada.

Geochemical ICP (5g) analysis for the Wilson, Christianson and Tingey report was completed by Geochemical Services Inc. and the XRF analyses (glass disk or pellets) by Brigham Young University.

Technical information contained in this news release has been reviewed and approved by Greg French, CPG, the Company's Vice President, Exploration, who is NevGold's Qualified Person under National Instrument 43-101 and responsible for technical matters of this release.

About the Company

NevGold is an exploration and development company targeting large-scale mineral systems in the proven districts of Nevada and Idaho. NevGold owns a 100% interest in the Limousine Butte and Cedar Wash gold projects in Nevada, and the Nutmeg Mountain gold project and Zeus copper project in Idaho.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Forward-looking statements include, but are not limited to, the proposed work programs at Limousine Butte, and the exploration potential at Limousine Butte. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such risks include, but are not limited to, general economic, market and business conditions, and the ability to obtain all necessary regulatory approvals. There is some risk that the forward-looking statements will not prove to be accurate, that the management's assumptions may not be correct or that actual results may differ materially from such forward-looking statements. Accordingly, readers should not place undue reliance on the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

References

Blackmon, D. (2021) Antimony: The Most Important Mineral You Never Heard Of. Article Prepared by Forbes.

Kurtenbach, E. (2024) China Bans Exports to US of Gallium, Germanium, Antimony in response to Chip Sanctions . Article Prepared by AP News.

Lv, A. and Munroe, T. (2024) China Bans Export of Critical Minerals to US as Trade Tensions Escalate . Article Prepared by Reuters.

Lv, A. and Jackson, L. (2025) China's Curbs on Exports of Strategic Minerals . Article Prepared by Reuters.

Perpetua Resources. (2025) Antimony Summary . Articles and Videos Prepared by Perpetua Resources.

Sangine, E. (2022) U.S. Geological Survey, Mineral Commodity Summaries, January 2023 . Antimony Summary Report prepared by U.S.G.S

U.S.G.S. (2022) U.S. Geological Survey Releases 2022 List of Critical Minerals . Reported Prepared by U.S.G.S

Wilson, D.,J., Christiansen, E., H., and Tingey, D., G., 1994, Geology and Geochemistry of the Golden Butte Mine- A Small Carlin- Type Gold Deposit in Eastern Nevada: Brigham Young University Geology Studies, v.40, P.185-211. BYU V.40 P.185-211.