Risk-on after weekend updates hint at constructive talks between China/US and EU/Ukraine, Bessent to brief at 08:00 BST - Newsquawk Europe Market Open

- US President Trump said there was a very good meeting with China on Saturday, and many things were discussed and much agreed to, while he stated a total reset was negotiated in a friendly but constructive manner.

- USTR Greer said differences are not as great as previously thought, and Treasury Secretary Bessent said he looks forward to sharing details on Monday morning.

- Chinese Vice Premier He Lifeng said trade talks were constructive, and they made substantive progress, while both sides reached an important consensus and agreed to establish a China-US trade consultation mechanism with a joint statement to be issued on May 12th.

- US President Tump said he will sign an executive order on Monday at 09:00EDT with prescription drug and pharmaceutical prices to be reduced almost immediately by 30%-80% and the US is to pay the same price as the nation that pays the lowest price anywhere in the world."

- Ukraine and European leaders said they agreed to an unconditional 30-day ceasefire on sea, land and air starting on May 12th and peace negotiations will start in that period if there is a ceasefire, while they said if Russia fails to comply, they will respond with massive sanctions and increased military aid.

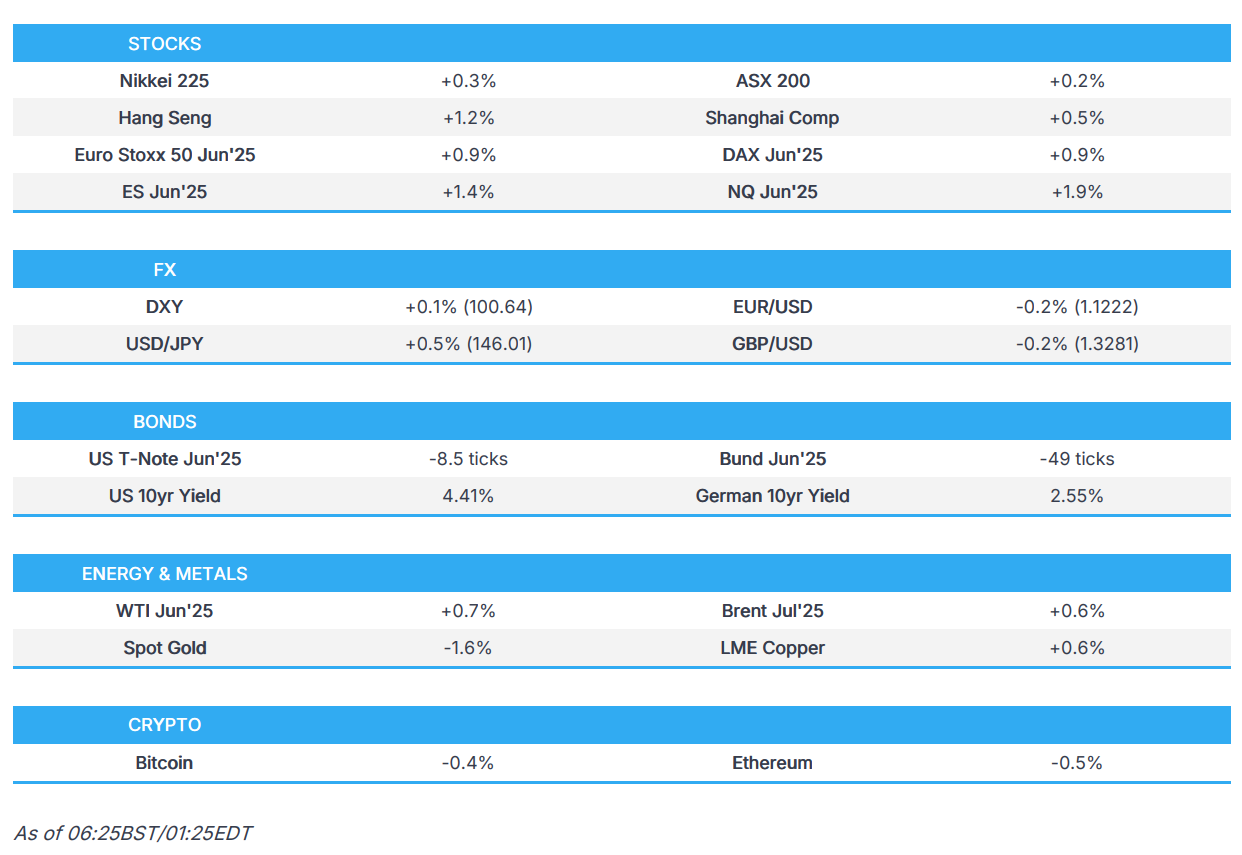

- APAC stocks began the week with mild gains amid hopes related to a US-China trade deal after substantive progress was said to have been made during talks in Switzerland over the weekend, but with gains capped given a lack of details announced so far and with the sides to provide a joint statement later today.

- US equity futures gapped higher; European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 0.9% after the cash market closed with gains of 0.4% on Friday.

- Looking ahead, highlights include US Federal Budget, Speakers including ECB’s Schnabel, BoE’s Lombardelli, Greene, Mann, Taylor & Fed’s Kugler, Earnings from Grifols, Almirall & Evonik.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were little changed as markets awaited US-China trade talks over the weekend with price action choppy in both stocks and Treasuries chopped after US President Trump floated the idea of a reduction in the China tariff to 80% from 145% but said it's up to the US Treasury Secretary Bessent, while the upside at the US cash open was short-lived as gains pared in equities with trading largely sideways for the remainder of the day.

- SPX -0.07% at 5,660, NDX -0.01% at 20,061, DJI -0.29% at -0.29% at 41,249, RUT -0.16% at 2,023.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said there was a very good meeting with China on Saturday and many things were discussed and much agreed to, while he stated a total reset was negotiated in a friendly but constructive manner. Trump also said great progress was made and they want to see for the good of both China and the US, an opening up of China to American business.

- USTR Greer said differences are not as great as previously thought, and Treasury Secretary Bessent said he looks forward to sharing details on Monday morning.

- Chinese Vice Premier He Lifeng said trade talks were constructive and they made substantive progress, while both sides reached an important consensus and agreed to establish a China-US trade consultation mechanism with a joint statement to be issued on May 12th. Furthermore, He said the atmosphere was candid, in-depth and constructive, and noted that the nature of relations is mutual win-win, and they are going to provide more certainty and stability in the world economy.

- Chinese Vice Commerce Minister Li Chenggang said any deal to be reached will be in China’s development interest and that they reached an important consensus with the two sides to have regular contact, while Li added that they are not in a position to release more substance on what they agreed on and declined to answer when asked about the timing of the statement but said it will be good news for the world.

- US President Trump’s administration opened a Section 232 investigation on whether imports of aircraft, engines and components are a threat to national security, while the Commerce Department is also investigating the impact of imported medium-duty and heavy-duty trucks on national security.

- White House Economic Adviser Hassett said the Chinese are ‘very, very eager’ to engage in trade talks and rebalance trade relations with the US, while he added that more trade deals could be coming as soon as this week. Furthermore, he said Commerce Secretary Lutnick briefed him about 24 deals that Lutnick and USTR Greer are working on, according to Fox News Sunday Morning Futures.

NOTABLE HEADLINES

- US President Trump posted on Truth Social “IN JUST THREE MONTHS, TRILLIONS OF DOLLARS (and therefore, record numbers of JOBS!) HAVE BEEN POURING INTO THE USA. THIS IS BECAUSE OF MY TARIFF POLICY, and our great November 5th Election WIN!”.

- US President Tump posted that his next TRUTH will be one of the most important and impactful he has ever issued and later posted that he will sign an executive order on Monday at 09:00EDT with prescription drug and pharmaceutical prices to be reduced almost immediately by 30%-80% and the US is to pay the same price as the nation that pays the lowest price anywhere in the world."

- Fed’s Cook (voter) said a less productive economy could need higher interest rates to contain inflation and that tariff policies could lower productivity, limit potential output and increase inflationary pressure, while Cook said less investment and higher costs could lower the economy’s potential output.

- Fed’s Musalem (2025 voter) said economic activity has moderated and sentiment has declined, while he added that they should not commit to rate cuts until the impact of tariffs on inflation becomes clear and rate cuts are still possible if increased inflation proves short-lived, expectations remain anchored, and the economy becomes meaningfully weaker.

- Fed’s Hammack (2026 voter) said on Friday that it is reasonable to take a wait and see approach and she would rather be slow and move in the right direction than be fast and wrong, while she said they will be ready to move on rates when there is clear and convincing evidence. Furthermore, she would like to be pre-emptive and action-oriented when possible, but noted it is hard given uncertainty over tariffs and other policies.

- US Treasury Secretary Bessent urged Congress to raise the debt limit by mid-July and expects the debt limit to be hit in August.

APAC TRADE

EQUITIES

- APAC stocks began the week with mild gains amid hopes related to a US-China trade deal after substantive progress was said to have been made during talks in Switzerland over the weekend, but with gains capped given a lack of details announced so far and with the sides to provide a joint statement later today.

- ASX 200 was led higher by the commodity-related sectors with outperformance in energy after the recent oil rally.

- Nikkei 225 advanced at the open with the help of a weaker currency but then briefly wiped out all of the gains with pressure seen in pharmaceuticals after US President Trump announced he will sign an executive order on Monday with prescription drug and pharmaceutical prices to be reduced almost immediately by 30%-80%.

- Hang Seng and Shanghai Comp were underpinned following US-China trade talks over the weekend in which both sides noted that progress was made and they agreed to establish a China-US trade consultation mechanism, although further upside was capped given the actual lack of details and after Y/Y Chinese CPI and PPI remained in deflation.

- US equity futures gapped higher with sentiment supported by trade hopes and positive geopolitical-related headlines.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 0.9% after the cash market closed with gains of 0.4% on Friday.

FX

- DXY traded rangebound with only minimal tailwinds seen from the US-China talks and after the latest Fedspeak did little to shift the dial including from Fed's Musalem who said that they should not commit to rate cuts until the impact of tariffs on inflation becomes clear but also stated that rate cuts are still possible if increased inflation proves short-lived, expectations remain anchored, and the economy becomes meaningfully weaker. Nonetheless, there are several notable data releases from the US this week including CPI figures on Tuesday and Retail Sales on Thursday.

- EUR/USD gapped lower at the open but remained at the 1.1200 territory and partially clawed back some of the initial declines, while the recent ECB rhetoric lacked any major fresh insight as ECB's Schnabel noted on Friday that the ECB should keep a steady hand and that rates should be held close to where they are now.

- GBP/USD was contained after reverting to beneath the 1.3300 handle in the absence of any major fresh catalysts from the UK and with several BoE speakers later today.

- USD/JPY gained as the trade hopes pressured haven currencies and lifted USD/JPY to briefly above the 146.00 level.

- Antipodeans mildly benefited from the trade-related optimism but with gains capped following the continued deflation for the world's second-largest economy.

- PBoC set USD/CNY mid-point at 7.2066 vs exp. 7.2429 (Prev. 7.2095).

FIXED INCOME

- 10yr UST futures retreated amid hopes for a de-escalation in the US-China trade war after substantial progress was said to be made in trade talks.

- Bund futures fell as risk sentiment was underpinned by several positive updates regarding trade and geopolitics.

- 10yr JGB futures conformed to the declines in global counterparts and breached the 140.00 level to the downside with prices not helped by a lack of tier-1 releases.

COMMODITIES

- Crude futures remained afloat after last week's gains and despite several geopolitical-related updates over the weekend including the latest round of US-Iran discussions which were said to be moving forward and with potential Ukraine-Russia direct talks in Turkey this Thursday.

- Saudi Aramco reported Q1 (USD) profits fell 4.6% Y/Y to 26bln, and rev. rose to 108.1bln (prev. 107.2bln Y/Y), while it stated that global trade dynamics affected energy markets in Q1 with economic uncertainty impacting oil prices.

- Spot gold slumped at the reopen as the US-China trade-related optimism saw havens lose their appeal.

- Copper futures notched mild gains albeit with the upside capped after Chinese inflation data remained in deflationary territory.

CRYPTO

- Bitcoin was ultimately flat overnight with price action choppy on both sides of the USD 104,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Ishiba said the government was ready to take further measures to cushion the economic impact from higher US tariffs but suggested that a cut in Japan's consumption tax was unlikely, according to Reuters.

DATA RECAP

- Chinese CPI MM (Apr) 0.1% vs. Exp. 0.0% (Prev. -0.4%)

- Chinese CPI YY (Apr) -0.1% vs. Exp. -0.1% (Prev. -0.1%)

- Chinese PPI YY (Apr) -2.7% vs. Exp. -2.8% (Prev. -2.5%)

GEOPOLITICS

MIDDLE EAST

- Senior Palestinian official said Hamas was in talks with the US administration regarding a Gaza ceasefire and aid. It was later reported that Hamas said it will release the last US hostage in Gaza as part of efforts to reach a Gaza ceasefire and allow humanitarian aid.

- Israeli PM Netanyahu’s office said the US informed Israel of Hamas’s intention to release Edan Alexander without any compensation or conditions and the US informed Israel that the move is expected to lead to negotiations for the release of further hostages, while Israel’s policy is that negotiations will be conducted under fire with a continued commitment to achieving all war objectives. PM Netanyahu later said that Israel has not committed to any ceasefire or prisoner release with Hamas, but only to a safe corridor for release of Edan Alexander, and negotiations for the release of other hostages will continue while preparations are made to intensify fighting in Gaza.

- Israeli army carried out major bombing operations in the city of Rafah, Southern Gaza Strip, according to Al Jazeera.

- Israel’s military issued evacuation warnings to people present in three Yemeni ports of Ras Isa, Hodeidah and Salif, while the Houthi interior minister said that Israel conducted an attack on Hodeidah.

- US envoy Witkoff held direct and indirect talks with Iran in Oman and an agreement was reached to move forward with talks to continue working through technical elements, according to a senior administration official.

- The fourth round of Iran-US nuclear talks was conducted in Oman which Iran’s Foreign Minister Araqchi said were more serious compared to previous rounds and talks are moving forward, while he stated that “now both sides have a better understanding from each others’ views” but added that Tehran’s uranium enrichment program is non-negotiable.

- Iran’s Foreign Minister Araqchi said Tehran continues nuclear talks with the US in good faith and Iran will not back down from and of its rights if the US goal of talks is to deprive Iran of its nuclear rights, while he added a nuclear agreement is possible if the US aim is non-proliferation of nuclear weapons and Oman’s Foreign Minister noted that the next round of talks will take place after both sides have consulted with their respective capitals.

RUSSIA-UKRAINE

- Ukraine and European leaders said they agreed to an unconditional 30-day ceasefire on sea, land and air starting on May 12th and peace negotiations will start in that period if there is a ceasefire, while they said if Russia fails to comply, they will respond with massive sanctions and increased military aid.

- Ukrainian President Zelensky said it is a positive sign that the Russians have finally begun to consider ending the war and the very first step in truly ending the war is a ceasefire. It was separately reported that Zelensky said Ukraine is ready to meet and he expects Russia to confirm a ceasefire beginning May 12th. Furthermore, Zelensky said Ukraine awaits a full ceasefire starting on Monday to provide a necessary basis for diplomacy and he will meet with Russian President Putin on Thursday in Turkey, and noted that the ceasefire beginning on Monday remains on the table and that Ukraine is awaiting a response from Russia but also noted that Ukraine will be ready to respond symmetrically if Russia violates the ceasefire.

- Russian drone attack on Ukraine rail infrastructure targets civilian freight train, injures locomotive driver, according to Ukrainain Railways which added that Russia is not observing Ukraine's proposal for ceasefire.

- Ukraine’s Foreign Minister said President Zelensky and visiting European leaders had a phone call with US President Trump on Saturday, which was constructive and they discussed peace efforts.

- Russian President Putin offered Ukraine to resume direct negotiations and talks will begin on May 15th in Istanbul with no pre-conditions. It was also reported that Kremlin aide Ushakov said proposed peace talks in Turkey will take into account the situation on the ground and 2022 negotiations.

- Russian President Putin held a call with Turkish President Erdogan and they discussed in detail an initiative to resume direct Russian-Ukrainian talks in Istanbul, while Turkish President Erdogan told French President Macron in a phone call that Turkey is ready to host negotiations for a ceasefire and permanent peace between Russia and Ukraine.

- Russian Defence Ministry said Russian troops continued the special military operation after the Victory Day ceasefire ended and Ukrainian troops made five attempts to break through the border in Kursk and Belgorod regions during the ceasefire. It was also reported that Russia launched an air attack on Kyiv and that a Ukrainian missile attack injured three in the town of Rylsk in Russia’s Kursk region.

- US President Trump posted on Truth that Ukraine should agree to meet with Russian President Putin on Thursday to negotiate, while he stated that he was starting to doubt that Ukraine would make a deal with Russian President Putin.

- Polish PM Tusk said the Russian secret service was behind the fire that almost completely destroyed a Warsaw shopping centre in May 2024.

INDIA-PAKISTAN

- India’s Foreign Ministry said Pakistan’s Director General of military operations called on Saturday and it was agreed that both sides would stop firing, while Pakistan’s Foreign Minister said this is not partial and it is a full-fledged ceasefire understanding between the two countries.

- India’s Foreign Secretary said Pakistan violated the ceasefire and that Indian armed forces responded, while the official said they call on Pakistan to halt the violence and India’s armed forces have been given the instruction to deal with violations along the border.

- Pakistan’s military said dozens of its armed drones hovered over major Indian cities including Delhi and 26 military targets and facilities were hit in India during operations carried out on Saturday.

- Pakistan’s Foreign Minister Dar spoke with Chinese Foreign Minister Wang and China reaffirmed it will continue to stand by Pakistan in upholding its sovereignty and territorial integrity.

- US President Trump said he will increase trade substantially with both India and Pakistan, while he said he will work with both to see if a solution can be reached concerning Kashmir.

EU/UK

NOTABLE HEADLINES

- ECB’s Schnabel said the ECB should keep a steady hand and rates should be held close to where they are now.

- ECB's Vujcic expects inflation to slow the ECB's 2% target by year-end, according to Bloomberg.