Virtual Investor Conferences, the leading proprietary investor conference series, today announced the presentations from the Metals and Mining Virtual Investor Conference, held May 6 th -8th are now available for online viewing.

£4.5 million Subscription by Institutional Investors, Advancing Development of the Pitfield Titanium Project

Empire Metals Limited (LON:EEE)(OTCQB:EPMLF), the AIM-quoted and OTCQB-traded resource exploration and development company, is pleased to announce that is has raised £4.5 million by way of a subscription of 47,368,423 new ordinary shares of no par value in the capital of the Company at 9.5p (the 'Subscription Shares') to existing and new institutional shareholders (the 'Subscription').

Shaun Bunn, Managing Director, said:"I am pleased to confirm the successful completion of this Subscription, which has increased participation from our institutional shareholders in Asia andAustralia. The Subscription was led by Asian Investment Management Services Ltd, an existing shareholder.

"The continued support from institutional investors highlights the scale and quality of the titanium discovery at Pitfield, and the opportunities that it brings. The additional funds strengthen our balance sheet, increasing our cash position to £7.1 million, and will be deployed to expand the planned drilling programme with the objective of establishing a globally significant Mineral Resource Estimate ('MRE'); progress the bulk metallurgical testwork so as to deliver high-purity TiO2 product samples to end users; and bring forward the commencement of economic studies.

"With momentum building in 2025, Empire is in a strong position to advance Pitfield and capitalise on the global focus on critical minerals such as titanium."

Use of Funds

The proceeds of the Subscription, together with existing cash reserves of £2.6 million, will be primarily used to:

- Expand the Pitfield titanium mineral resource development drilling programme to define a globally significant MRE;

- Appoint additional metallurgical and engineering personnel to accelerate the development of the process flowsheet;

- Upscale the bulk metallurgical testwork to provide high-purity TiO2 product samples to potential end users; and

- Accelerate the commencement of mining studies, well ahead of schedule.

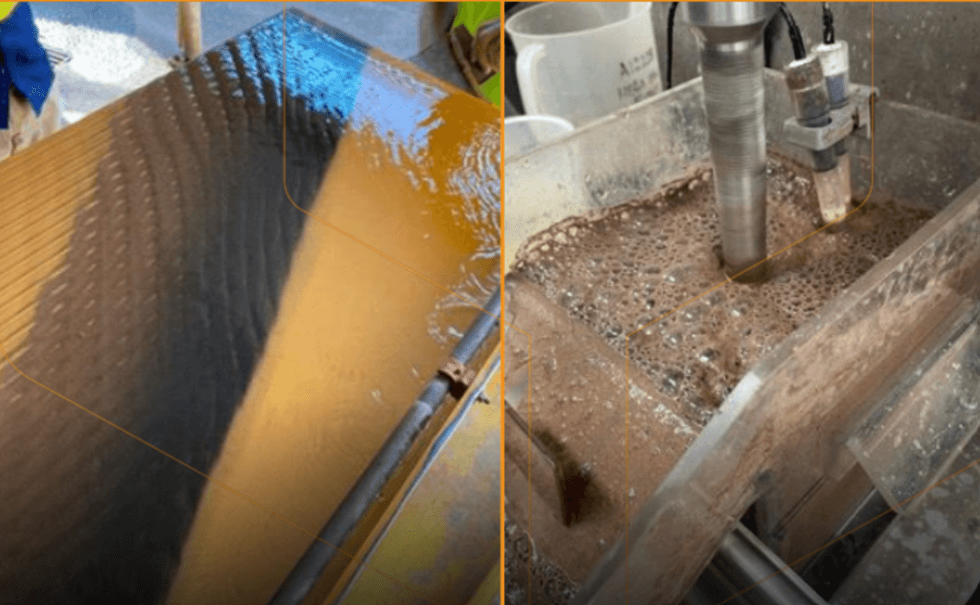

Laboratory testwork results to date have been encouraging and the use of conventional processing techniques has increased management's confidence that the process flowsheet can deliver high-value commercial end products. Development focus now has turned to optimising the various processing steps and commencing mine option studies. Proceeds from this equity placement fully fund the Company through these important, project development workstreams.

Application for Admission and Total Voting Rights

The Subscription Shares will rank pari passu in all respects with the existing ordinary shares of no par value in the capital of the Company. Application has been made to the London Stock Exchange for the Subscription Shares to be admitted to trading on AIM ('Admission'). It is expected that Admission will become effective on or around 30 May 2025. As a result of the issue of the Subscription Shares as described above, the issued share capital of the Company now consists of 689,633,233 ordinary shares of no-par value.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.com or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON: EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

Empire Metals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Empire Metals

Investor Insight

Empire Metals (OTCQB:EPMLF, AIM:EEE) is unlocking one of the world’s largest and purest titanium deposits at its flagship Pitfield project in Western Australia. With growing global demand, a looming supply deficit, and near-term development milestones, Empire offers a compelling investment opportunity in the critical minerals space.

Overview

Empire Metals (OTCQB:EPMLF, AIM:EEE) is an Australian focused exploration and resource development company rapidly gaining international attention for its discovery and rapid development of what is believed to be the world’s largest titanium deposit.

The company is focused on advancing its flagship asset, the Pitfield project, located in Western Australia, a tier 1 mining jurisdiction. With a dominant landholding of more than 1,000 sq km, and a titanium mineral system that spans 40 km in strike length, Pitfield is emerging as a district-scale “giant” discovery with the potential to reshape the global titanium supply landscape.

Empire’s strategic focus on titanium comes at a pivotal time. Titanium is officially recognized as a critical mineral by both the European Union and the United States, owing to its essential role in aerospace, defense, medical technologies, clean energy and high-performance industrial applications. Global demand for titanium dioxide — the most widely used form of titanium — is surging due to its unmatched properties as a pigment and as a feedstock for titanium metal. Titanium supply chains are also increasingly being constrained by geopolitical risks, mine depletion and environmental challenges associated with traditional production. More than 60 percent of the global supply chain is currently concentrated in a handful of countries, notably China and Russia, creating significant vulnerabilities for Western markets.

Titanium has been designated as a critical mineral in both the EU and the US.

Against this backdrop, Empire Metals offers investors a compelling opportunity to gain exposure to a strategically vital metal through a large-scale, high-grade and clean titanium discovery. Unlike many traditional titanium sources, Pitfield's mineralization is exceptionally pure — free from detrimental amounts of uranium, thorium, chromium and other contaminants — making it ideally suited for premium, high-purity end markets. Furthermore, the mineralized zone is near-surface and laterally extensive, allowing for low-strip and scalable bulk mining with conventional processing technologies.

With more than 22,000 meters of drilling already completed and only a fraction of the mineral system tested, Empire is aggressively advancing Pitfield towards a maiden JORC-compliant mineral resource estimate, targeted for H2-2025. Alongside this work, the company is also undertaking bulk sampling and metallurgical processing to advance flowsheet design and optimize product specifications. It is also engaging with industry players to assess product suitability for premium pigment and titanium sponge markets. Empire is planning to finalize, during the current calendar year, a mining study to evaluate the potential for a low-cost strip mining approach, utilizing continuous mining techniques.

The company is supported by a seasoned leadership team with deep expertise in exploration, resource development, mining, metallurgy and capital markets — ensuring that strategic decisions are guided by both technical excellence and a strong track record of value creation.

Company Highlights

- The flagship Pitfield project is the world’s largest known titanium discovery. It’s a district-scale “giant” titanium mineral system, characterised by high-grade, high-purity titanium mineralisation exhibiting exceptional continuity.

- Titanium is in a global supply deficit and recognized as a critical mineral by the EU and US.

- Drill intercepts at Pitfield include up to 202 meters at 6.32 percent titanium dioxide (TiO2) from surface, confirming vast scale and grade.

- Empire Metals operates in one of the world’s most secure, mining-friendly jurisdictions: Western Australia.

- The company is led by an experienced, agile team, with proven expertise in exploration, mine development, and value creation across multiple commodities.

- With a number of key development catalysts planned for 2025, including a maiden resource estimate, bulk sampling for scale-up of metallurgical testwork, and product optimisation, Empire remains significantly undervalued relative to its peers.

Key Projects

Pitfield Project – A World-Class Titanium Discovery

Located in Western Australia, the Pitfield project is Empire Metals’ flagship asset and represents one of the most exciting titanium discoveries globally. Spanning an area of approximately 1,042 sq km, the project has revealed a colossal mineral system measuring 40 km in length and up to 8 km in width, with geophysical indications of mineralization extending to at least a depth of 5 km.

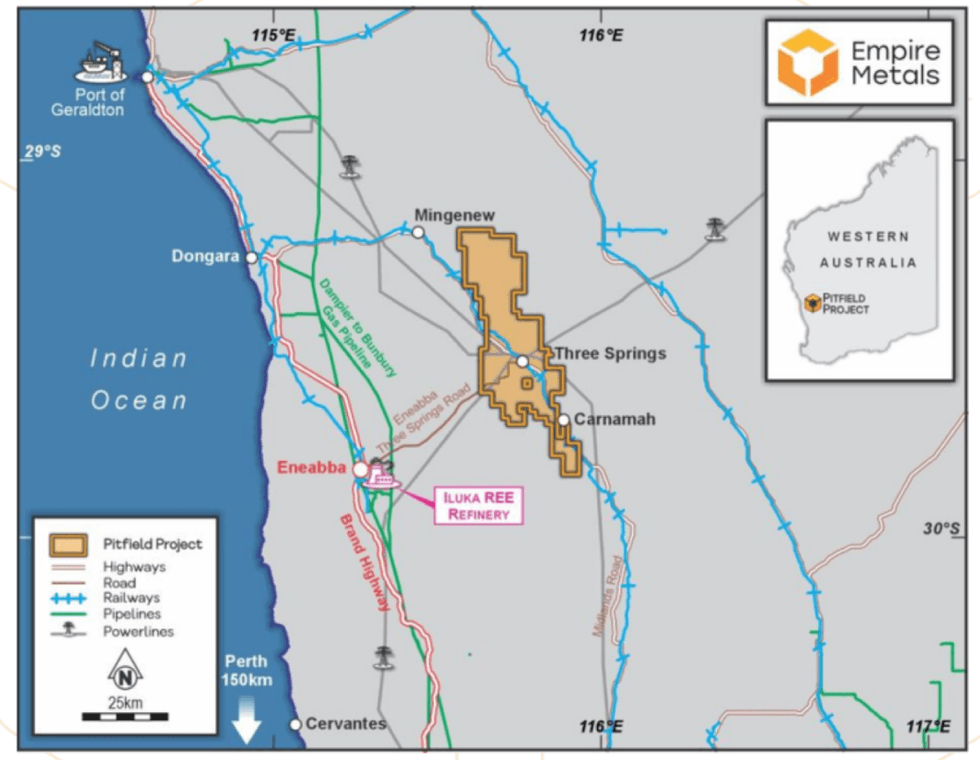

Pitfield’s prime location in Western Australia

Extensive drilling across the project has intercepted thick, laterally continuous zones of high-grade titanium dioxide mineralization, highlighting the system’s enormous scale and consistency.

The titanium at Pitfield occurs predominantly in the minerals anatase and rutile within a weathered, in-situ cap that begins at surface. These minerals are exceptionally pure, often exceeding 90 percent titanium dioxide. They are free from harmful amounts of contaminants like uranium, thorium, chromium and phosphorus — qualities that are likely to make the deposit uniquely suitable for premium, high-purity titanium applications in aerospace, defense and clean technologies.

Pitfield is strategically located near the town of Three Springs, approximately 150 km southeast of the port city of Geraldton. The project benefits from direct access to essential infrastructure, including sealed highways, rail lines and an available water supply. This connectivity significantly enhances development potential by reducing logistics costs and simplifying future project build-out. Moreover, the Western Australian government actively supports critical mineral development, and Empire is operating within a stable, mining-friendly jurisdiction known for streamlined permitting and investment security.

Empire has completed more than 22,000 meters of drilling, confirming standout titanium dioxide (TiO2) results such as 154 meters at 6.76 percent TiO2, 148 meters at 6.49 percent TiO2, and 150 meters at 6.44 percent TiO2. Notably, mineralization remains open at depth in all tested zones, and to date, only around 5 percent of the interpreted system has been drilled. This underscores the immense upside potential for resource expansion.

The project’s development advantages are equally compelling: the mineralization is near-surface and amenable to simple, bulk mining methods with conventional processing. Its location in a tier-one mining jurisdiction offers access to infrastructure, a skilled workforce and strong regulatory support.

The Pitfield project presents a scalable processing pathway. Photo shows a gravity flotation test in process (left) and a close-up of a flotation test (right)

Pitfield is advancing toward a maiden JORC-compliant mineral resource estimate, expected by H2-2025. The project is already being recognized as a potential cornerstone asset in the global titanium supply chain.

Other Projects

In addition to Pitfield, Empire Metals maintains a portfolio of early-stage exploration assets offering optionality and exposure to other strategic and precious metals. Empire holds interests in two Western Australian projects — the Walton and Eclipse gold projects — both situated in historically productive mineral belts. While these assets are not the current focus, they contribute exploration upside and optionality within the company’s broader strategy.

Board and Management Team

Neil O’Brien - Non-executive Chairman

Neil O’Brien is the former SVP exploration and new business development at Lundin

Mining, until he retired in 2018. He has an extensive global mining career as a PhD economic geologist, exploration leader and board executive.

Shaun Bunn - Managing Director

Shaun Bunn is a metallurgist based in Perth, Western Australia, with expertise in international exploration, mining, processing and development. He has a successful track record managing mining projects through all stages of development.

Greg Kuenzel - Finance Director

Based in London, Greg Kuenzel is a chartered accountant, and corporate finance and financial management expert. He has extensive experience working with resources-focused AIM listed companies.

Peter Damouni - Non-executive Director

With more than 20 years of corporate and finance experience focused in the natural resources sector, Peter Damouni holds executive and director roles in TSXV and LSE listed companies where he has played key roles in significantly enhancing shareholder value.

Phil Brumit - Non-executive Director

Phil Brumit is a veteran mining engineer and operations expert, delivering major global operations. His previous roles include international leadership positions at Freeport-McMoRan, Lundin Mining and Newmont Corporation.

Narelle Marriott - Process Development Manager

Narelle Marriott is a former BHP senior process engineer. Most recently, she was the general manager for process development for Hastings Technology Metals.

Andrew Faragher - Exploration Manager

Andrew Faragher is a former Rio Tinto exploration manager with more than 25 years of experience working across multiple commodities.

Arabella Burwell - Corporate Development

Arabella Burwell is a former Senior Director Corporate Development at NASDAQ-listed GoDaddy and a Partner, Capital Raising and Strategic Partnerships, at Hannam & Partners in London and South Africa.

Carrie Pritchard – Environmental Manager

Carrie brings over 20 years of international experience in environmental management, project development, regulatory approvals, and impact assessment. Her expertise spans mine closure and reclamation, stakeholder engagement, and the remediation of contaminated sites. She has led projects across Australia (Western Australia and Victoria) and New Zealand and has also contributed to initiatives in Malawi and Greenland.

David Parker – Commercial Manager

David Parker brings over 20 years of experience in equity capital markets, with a strong focus on the mining, industrial, and technology sectors. He has held senior roles as director and company secretary for several ASX-listed companies, providing strategic leadership and commercial oversight across diverse corporate environments.

Advancing a game-changing, globally significant titanium project in Western Australia.

Empire Metals Limited Announces Major Drilling Campaign Targeting Maiden MRE

Empire Metals Limited (LON:EEE), the AIM-quoted and OTCQB-traded exploration and development company,is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or the 'Project'). This programme will target high-grade titanium mineralisation within the in-situ weathered cap at the Thomas Prospect, with the objective of delivering a maiden JORC Compliant Mineral Resource Estimate ('MRE').

Highlights

- A total of 164 drill holes planned:

- 124 Air Core ('AC') drillholes for approximately 6,700 metres, and

- 40 Reverse Circulation ('RC') drillholes for approximately 4,000 metres,

- totalling 10,700 metres of drilling.

- The Thomas Prospect was selected for the maiden MRE due to the extensive, thick and high-grade titanium mineralisation hosted within the broad, in-situ weathered zone.

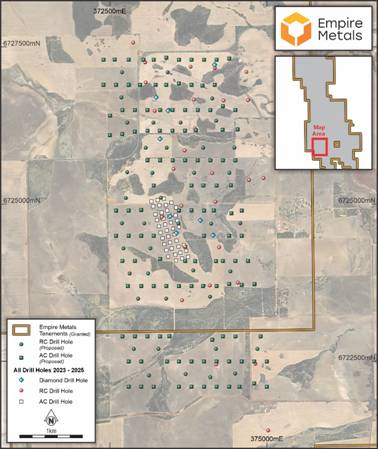

- This programme, the largest at Pitfield to date, will cover over 11 square kilometres and aims to deliver a globally significant MRE.

- Notable intercepts within the in-situ weathered cap from previous drilling at Thomas include:

- 51m @ 7.88% TiO₂ from surface (AC25TOM039)

- 57m @ 7.48% TiO₂ from surface (AC25TOM040)

- 52m @ 7.43% TiO₂ from surface (AC25TOM042)

Shaun Bunn, Managing Director, said:"We are pleased to commence this important drilling campaign at Pitfield, focused on delivering our maiden MRE from the Thomas Prospect.The Thomas Prospect contains broad, continuous, high-grade zones of high-purity titanium dioxide mineralisation within the in-situ weathered cap: confirmed by assay results from the February 2025 AC drill campaign, averaging 6.20% TiO₂ over an average depth of 54m (announced 28 April 2025).

"This fully funded campaign, scheduled to run over the next four to five weeks, is the largest undertaken to date at Pitfield. With 164 holes planned over an 11 square kilometre area and to an average depth of 65 metres, this work is designed to deliver a globally significant Mineral Resource Estimate."

MRE Drilling Programme

The location and spacing of the planned AC drillholes have been designed, with the input of mineral resource consultants Snowden-Optiro, to provide the necessary drill assay data density to allow the preparation of an MRE at the Thomas Prospect. The programme consists of 124 AC drillholes, on a 400 x 200m drillhole-spaced grid with an average forecast depth of 54.1m, for a total of 6,700 metres, and 40 RC drillholes within the AC drilling grid, to a depth of 100m, for a total of 4,000 metres. The overall drillhole grid extends 5.2km by 2.2km and totals an area of 11.4 sq km (refer Figure 1).

The drilling is targeting the near surface, highly weathered zones within the Thomas Prospect; drilling has now commenced and will run over several weeks, with laboratory analysis scheduled for completion in August.

Figure 1. Planned Air Core drill hole collar locations within the Thomas Prospect priority area.

The near-surface, in-situ weathered cap at the Thomas Prospect contains a high percentage of the key titanium bearing minerals, primarily anatase and rutile. The drilling targets areas were selected on the basis of three key parameters: high-purity TiO2 mineral assemblage, high average TiO2 grades and significant depth of weathering (refer Table 1).

The AC and RC drillholes will be geologically logged and sub-sampled on 2m intervals and geochemically analysed; this data will provide the basis for geological modelling and for the development of the MRE at the Thomas Prospect.

Air core drilling has previously been utilised at Pitfield to drill-test the weathered cap and collect bulk metallurgical samples (announced 28 April 2025). It is a cost-effective and efficient drilling method that is commonly used for shallow exploration projects and the success of the previous campaign confirmed its suitability for the preparation of the MRE.

Table 1: Weathered Zone drill intercepts from the Thomas Prospect (previously released results) including high-grade intervals to be followed up by MRE drilling

Hole ID | Easting | Northing | Depth From (m) | Depth To (m) | EOH (m) | Weathered Interval (m) | Grade TiO2 (%) |

RC24TOM021 | 373699 | 6724326 | 4 | 76 | 154 | 72 | 6.75 |

including | 4 | 58 | 54 | 6.90 | |||

including | 4 | 12 | 8 | 9.03 | |||

including | 8 | 10 | 2 | 9.98 | |||

RC24TOM022 | 373329 | 6724796 | 0 | 54 | 154 | 54 | 7.02 |

including | 4 | 12 | 8 | 8.54 | |||

RC24TOM023 | 373639 | 6724978 | 0 | 58 | 154 | 58 | 5.68 |

including | 6 | 20 | 14 | 6.09 | |||

DD24TOM006 | 373947 | 6724741 | 0 | 46.5 | 70.5 | 46.5 | 5.94 |

including | 4.5 | 45 | 40.5 | 6.10 | |||

including | 10.5 | 22.5 | 12 | 6.95 | |||

AC25TOM021 | 373250 | 6724746 | 0 | 49 | 49 | 49 | 7.49 |

including | 20 | 26 | 6 | 10.71 | |||

AC25TOM036 | 373358 | 6725089 | 2 | 54 | 54 | 52 | 7.21 |

AC25TOM039 | 373506 | 6724612 | 0 | 51 | 51 | 51 | 7.88 |

AC25TOM040 | 373599 | 6724639 | 0 | 57 | 57 | 57 | 7.48 |

including | 6 | 22 | 16 | 10.00 | |||

AC25TOM041 | 373572 | 6724737 | 0 | 54 | 54 | 54 | 7.19 |

including | 4 | 18 | 14 | 10.06 | |||

including | 4 | 12 | 8 | 11.67 | |||

AC25TOM042 | 373546 | 6724823 | 0 | 52 | 52 | 52 | 7.43 |

including | 4 | 16 | 12 | 10.17 | |||

including | 4 | 12 | 8 | 11.32 |

The Pitfield Titanium Project

Located within the Mid-West region of Western Australia, near the northern wheat belt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region's capital and major port. Western Australia is ranked as one of the top mining jurisdictions in the world according to the Fraser Institute's Investment Attractiveness Index published in 2023, and has mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines as well as a green energy hydrogen fuel hub, which is under planning and development (refer Figure 2).

Figure 2. Pitfield Project Location showing the Mid-West Region Infrastructure and Services

Competent Person Statement

The technical information in this report that relates to the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr Faragher is a Member of the Australian Institute of Mining and Metallurgy. Mr Faragher has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

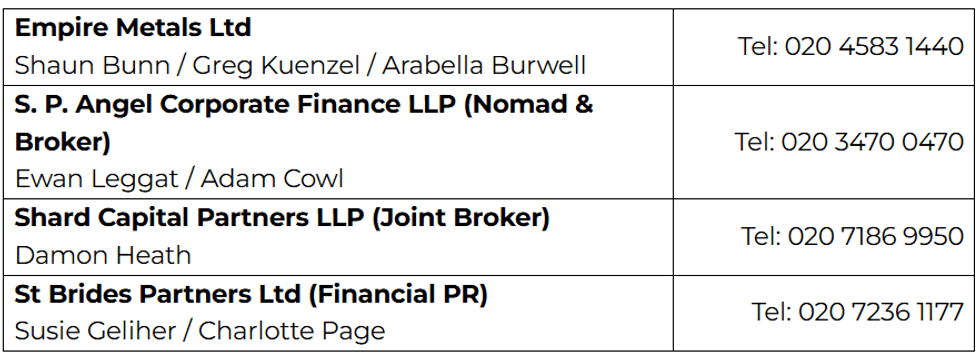

Empire Metals Ltd Shaun Bunn / Greg Kuenzel / Arabella Burwell | Tel: 020 4583 1440 |

S. P. Angel Corporate Finance LLP (Nomad & Broker) Ewan Leggat / Adam Cowl | Tel: 020 3470 0470 |

Shard Capital Partners LLP (Joint Broker) Damon Heath | Tel: 020 7186 9950 |

St Brides Partners Ltd (Financial PR) Susie Geliher / Charlotte Page | Tel: 020 7236 1177 |

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON: EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

Click here to connect with Empire Metals (OTCQB:EPMLF, AIM:EEE) to receive an Investor Presentation

Metals and Mining Virtual Investor Conference: Presentations Now Available for Online Viewing

The company presentations will be available 24/7 for 90 days. Investors, advisors, and analysts may download investor materials from the company's resource section.

Select companies are accepting 1x1 management meeting requests through May 13th.

May 6th

| Presentation | Ticker(s) |

| Northern Superior Resources Inc. | (OTCQB: NSUPF | TSXV: SUP) |

| Luca Mining Corp. | (OTCQX: LUCMF | TSXV: LUCA) |

| Castille Resources Limited | (OTCQB: CLRSF | ASX: CST) |

| Sun Summit Minerals Corp. | (OTCQB: SMREF | TSXV: SMN) |

| Amex Exploration Inc. | (OTCQX: AMXEF | TSXV: AMX) |

| Ucore Rare Metals, Inc. | (OTCQX: UURAF | TSXV: UCU) |

| Kootenay Silver Inc. | (OTCQX: KOOYF | TSXV: KTN) |

| Camino Minerals Corp. | (Pink: CAMZF | TSXV: COR) |

| Precipitate Gold Corp. | (OTCQB: PREIF | TSXV: PRG) |

| Callinex Mines Ltd. | (OTCQX: CLLXF | TSXV: CNX) |

May 7th

| Presentation | Ticker(s) |

| Canada Nickel Company Inc. | (OTCQX: CNIKF| TSXV: CNC) |

| Anfield Energy Inc. | (OTCQB: ANLDF | TSXV: AEC) |

| Newcore Gold Ltd. | (OTCQX: NCAUF | TSXV: NCAU) |

| Empire Metals Ltd. | (OTCQB: EPMLF | AIM: EEE) |

| Cerrado Gold Inc. | (OTCQX: CRDOF | TSXV: CERT) |

| Silver Tiger Metals Inc. | (OTCQX: SLVTF | TSXV: SLVR) |

| Horizon Copper Corp. | (OTCQX: HNCUF | TSXV: HCU) |

| Kodiak Copper Corp. | (OTCQB: KDKCF | TSXV: KDK ) |

| Rua Gold Inc. | (OTCQB: NZAUF | TSXV: RUA) |

| DynaResource, Inc. | (OTCQX: DYNR) |

May 8 th

| Presentation | Ticker(s) |

| Novo Resources Corp. | (OTCQB: NSRPF | TSX: NVO) |

| Ecora Resources PLC | (OTCQX: ECRAF | TSX: ECOR) |

| Power Metallic Mines Inc. | (OTCQB: PNPNF | TSXV: PNPN) |

To facilitate investor relations scheduling and to view a complete calendar of Virtual Investor Conferences, please visit www.virtualinvestorconferences.com .

About Virtual Investor Conferences ®

Virtual Investor Conferences (VIC) is the leading proprietary investor conference series that provides an interactive forum for publicly traded companies to seamlessly present directly to investors.

Providing a real-time investor engagement solution, VIC is specifically designed to offer companies more efficient investor access. Replicating the components of an on-site investor conference, VIC offers companies enhanced capabilities to connect with investors, schedule targeted one-on-one meetings and enhance their presentations with dynamic video content. Accelerating the next level of investor engagement, Virtual Investor Conferences delivers leading investor communications to a global network of retail and institutional investors.

Media Contact:

OTC Markets Group Inc. +1 (212) 896-4428, media@otcmarkets.com

Virtual Investor Conferences Contact:

John M. Viglotti

SVP Corporate Services, Investor Access

OTC Markets Group

(212) 220-2221

johnv@otcmarkets.com

News Provided by GlobeNewswire via QuoteMedia

Metals and Mining Virtual Investor Conference: Presentations Now Available for Online Viewing

Virtual Investor Conferences, the leading proprietary investor conference series, today announced the presentations from the Metals and Mining Virtual Investor Conference, held May 6 th -8th are now available for online viewing.

The company presentations will be available 24/7 for 90 days. Investors, advisors, and analysts may download investor materials from the company's resource section.

Select companies are accepting 1x1 management meeting requests through May 13th.

May 6th

| Presentation | Ticker(s) |

| Northern Superior Resources Inc. | (OTCQB: NSUPF | TSXV: SUP) |

| Luca Mining Corp. | (OTCQX: LUCMF | TSXV: LUCA) |

| Castille Resources Limited | (OTCQB: CLRSF | ASX: CST) |

| Sun Summit Minerals Corp. | (OTCQB: SMREF | TSXV: SMN) |

| Amex Exploration Inc. | (OTCQX: AMXEF | TSXV: AMX) |

| Ucore Rare Metals, Inc. | (OTCQX: UURAF | TSXV: UCU) |

| Kootenay Silver Inc. | (OTCQX: KOOYF | TSXV: KTN) |

| Camino Minerals Corp. | (Pink: CAMZF | TSXV: COR) |

| Precipitate Gold Corp. | (OTCQB: PREIF | TSXV: PRG) |

| Callinex Mines Ltd. | (OTCQX: CLLXF | TSXV: CNX) |

May 7th

| Presentation | Ticker(s) |

| Canada Nickel Company Inc. | (OTCQX: CNIKF| TSXV: CNC) |

| Anfield Energy Inc. | (OTCQB: ANLDF | TSXV: AEC) |

| Newcore Gold Ltd. | (OTCQX: NCAUF | TSXV: NCAU) |

| Empire Metals Ltd. | (OTCQB: EPMLF | AIM: EEE) |

| Cerrado Gold Inc. | (OTCQX: CRDOF | TSXV: CERT) |

| Silver Tiger Metals Inc. | (OTCQX: SLVTF | TSXV: SLVR) |

| Horizon Copper Corp. | (OTCQX: HNCUF | TSXV: HCU) |

| Kodiak Copper Corp. | (OTCQB: KDKCF | TSXV: KDK ) |

| Rua Gold Inc. | (OTCQB: NZAUF | TSXV: RUA) |

| DynaResource, Inc. | (OTCQX: DYNR) |

May 8 th

| Presentation | Ticker(s) |

| Novo Resources Corp. | (OTCQB: NSRPF | TSX: NVO) |

| Ecora Resources PLC | (OTCQX: ECRAF | TSX: ECOR) |

| Power Metallic Mines Inc. | (OTCQB: PNPNF | TSXV: PNPN) |

To facilitate investor relations scheduling and to view a complete calendar of Virtual Investor Conferences, please visit www.virtualinvestorconferences.com .

About Virtual Investor Conferences ®

Virtual Investor Conferences (VIC) is the leading proprietary investor conference series that provides an interactive forum for publicly traded companies to seamlessly present directly to investors.

Providing a real-time investor engagement solution, VIC is specifically designed to offer companies more efficient investor access. Replicating the components of an on-site investor conference, VIC offers companies enhanced capabilities to connect with investors, schedule targeted one-on-one meetings and enhance their presentations with dynamic video content. Accelerating the next level of investor engagement, Virtual Investor Conferences delivers leading investor communications to a global network of retail and institutional investors.

Media Contact:

OTC Markets Group Inc. +1 (212) 896-4428, media@otcmarkets.com

Virtual Investor Conferences Contact:

John M. Viglotti

SVP Corporate Services, Investor Access

OTC Markets Group

(212) 220-2221

johnv@otcmarkets.com

News Provided by GlobeNewswire via QuoteMedia

Empire Metals Limited Announces Conference Presentations in Australia & N America

Empire Metals Limited (LON:EEE)(OTCQB:EPMLF), the AIM-listed and OTCQB-traded resource exploration and development company, is pleased to inform investors of its upcoming participation in two key industry events:

- RIU Sydney Resources Round-up (6-8 May 2025 at the Hyatt Regency in Sydney, NSW), where the Company will be delivering a presentation to delegates and will meet existing and prospective investors at its booth in the exhibition area; and

- OTC Metals & Mining Virtual Investor Conference (6-8 May 2025), where Empire will present to a global online audience of investors and industry participants. Investors can learn more about the event and register at www.virtualinvestorconferences.com.

These events provide an opportunity for the Company to update shareholders and potential investors on recent developments and strategic plans, including highlights from the ongoing exploration and development activities at the Pitfield Project and other key announcements made in recent weeks.

An updated corporate presentation, reflecting the Company's latest developments, is available on the Company's website at: https://www.empiremetals.com/investors/shareholder-documents/presentations/.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON:EEE)(OTCQB:EPMLF) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by Reach, the non-regulatory press release distribution service of RNS, part of the London Stock Exchange. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

Metals & Mining Virtual Investor Conference Agenda Announced for May 6-8th

Virtual Investor Conferences, the leading proprietary investor conference series announced the agenda for the Metals & Mining Virtual Investor Conference held May 6-8 th .

Individual investors, institutional investors, advisors, and analysts are invited to attend.

It is recommended that investors pre-register and run the online system check to expedite participation and receive event updates. There is no cost to log-in, attend live presentations, or schedule 1x1 meetings with management.

"We are excited to welcome a full roster of over 20 OTCQX and OTCQB companies to our 3-day Metals and Mining Virtual Investor Conference," said Jason Paltrowitz, Executive Vice President of Corporate Services at OTC Markets Group. "Our platform is tailored to meet the needs of today's resource companies as they look to engage a broader investor base."

May 6th

| Eastern Time (ET) | Presentation | Ticker(s) |

| 9:30 AM ET | Northern Superior Resources Inc. | (OTCQB: NSUPF | TSXV: SUP) |

| 10:00 AM ET | Luca Mining Corp. | (OTCQX: LUCMF | TSXV: LUCA) |

| 10:30 AM ET | Castile Resources Limited | (OTCQB: CLRSF | ASX: CST) |

| 11:00 AM ET | Sun Summit Minerals Corp. | (OTCQB: SMREF | TSXV: SMN) |

| 11:30 AM ET | Amex Exploration Inc. | (OTCQX: AMXEF | TSXV: AMX) |

| 12:00 PM ET | Ucore Rare Metals, Inc. | (OTCQX: UURAF | TSXV: UCU) |

| 12:30 PM ET | Kootenay Silver Inc. | (OTCQX: KOOYF | TSXV: KTN) |

| 1:00 PM ET | Camino Minerals Corp. | (Pink: CAMZF | TSXV: COR) |

| 2:00 PM ET | Precipitate Gold Corp. | (OTCQB: PREIF | TSXV: PRG) |

| 3:00 PM ET | Callinex Mines Ltd. | (OTXQX: CLLXF | TSXV: CNX) |

May 7th

| Eastern Time (ET) | Presentation | Ticker(s) |

| 9:30 AM ET | Canada Nickel Company Inc. | (OTCQX: CNIKF| TSXV: CNC) |

| 10:30 AM ET | Anfield Energy Inc. | (OTCQB: ANLDF | TSXV: AEC) |

| 11:00 AM ET | Newcore Gold Ltd. | (OTCQX: NCAUF | TSXV: NCAU) |

| 11:30 AM ET | Empire Metals Ltd. | (OTCQB: EPMLF | AIM: EEE) |

| 12:30 PM ET | Cerrado Gold Inc. | (OTCQX: CRDOF | TSXV: CERT) |

| 1:00 PM ET | Silver Tiger Metals Inc. | (OTCQX: SLVTF | TSXV: SLVR) |

| 1:30 PM ET | Horizon Copper Corp. | (OTCQX: HNCUF | TSXV: HCU) |

| 2:00 PM ET | Kodiak Copper Corp. | (OTCQB: KDKCF | TSXV: KDK ) |

| 2:30 PM ET | Rua Gold Inc. | (OTCQB: NZAUF | TSXV: RUA) |

| 3:00 PM ET | DynaResource, Inc. | (OTCQX: DYNR) |

May 8 th

| Eastern Time (ET) | Presentation | Ticker(s) |

| 9:30 AM ET | Novo Resources Corp. | (OTCQB: NSRPF | TSX: NVO) |

| 10:00 AM ET | Ecora Resources PLC | (OTCQX: ECRAF | TSX: ECOR) |

| 10:30 AM ET | Power Metallic Mines Inc. | (OTCQB: PNPNF | TSXV: PNPN) |

To facilitate investor relations scheduling and to view a complete calendar of Virtual Investor Conferences, please visit www.virtualinvestorconferences.com .

About Virtual Investor Conferences ®

Virtual Investor Conferences (VIC) is the leading proprietary investor conference series that provides an interactive forum for publicly traded companies to seamlessly present directly to investors.

Providing a real-time investor engagement solution, VIC is specifically designed to offer companies more efficient investor access. Replicating the components of an on-site investor conference, VIC offers companies enhanced capabilities to connect with investors, schedule targeted one-on-one meetings and enhance their presentations with dynamic video content. Accelerating the next level of investor engagement, Virtual Investor Conferences delivers leading investor communications to a global network of retail and institutional investors.

Media Contact:

OTC Markets Group Inc. +1 (212) 896-4428, media@otcmarkets.com

Virtual Investor Conferences Contact:

John M. Viglotti

SVP Corporate Services, Investor Access

OTC Markets Group

(212) 220-2221

johnv@otcmarkets.com

News Provided by GlobeNewswire via QuoteMedia

Juggernaut Announces Financing of $1,100,000 from Institutions and Accredited Investors

(TheNewswire)

Vancouver, British Columbia June 4 th 2025 TheNewswire - Juggernaut Exploration Ltd. (TSX-V: JUGR) (OTCQB: JUGRF) (FSE: 4JE) (the "Company" or "Juggernaut"), is pleased to announce a fully subscribed $1,100,000 hard dollar financing further confirming the quality of the newly discovered 11 km Highway of Gold surrounding the Eldorado porphyry system on the Big One property. The discovery is in an area of glacial and snowpack abatement next door to the gold-rich porphyry systems at Newmont Mining's Galore Creek. The Big One Property is a discovery previously announced Jan 20 th (Click Link) with assays up to 79.01 gt gold (2.54 ozt gold) and 3157.89 gt silver (101.5 ozt silver) from over 200 gold-silver-copper rich polymetallic veins up to 8 m wide and striking for up to 500 m that all remain open at surface. The Big One Project covers 33,693 hectares in a globally ranked tier 1 jurisdiction with tremendous additional discovery potential in the heart of the Golden Triangle, British Columbia.

View Juggernaut videos by Clicking Here .

Juggernaut is raising up to 1,718,750 hard dollar units priced at $0.64 each for gross proceeds of up to $1,100,000. Each hard dollar unit will consist of one common share plus one warrant at $0.84 for a sixty-month period, with a forced accelerated conversion after 10 consecutive trading days at or above $1.84, callable at management's discretion. The fully subscribed placement is scheduled to close on June 13th, 2025. The proceeds will be used for general working capital.

Mr. Dan Stuart, Director, President, and CEO of Juggernaut, states:

This investment, coupled with the ongoing support and interest from other globally recognized Institutions and senior miners, is a strong endorsement that clearly demonstrates the significant near-term discovery potential of our 100% controlled properties. Post financing, Juggernaut will have an extremely tight capital structure of just 29,422,689 shares, no debt, and a strong cash position of ~ $11,000,000. As such, we are well-positioned to move forward with our plans of drilling The Big One Discovery. With much anticipation, we look forward to executing the inaugural exploration program and reporting results."

The Company may pay finder's fees of the gross proceeds from the financing in cash, and compensation options on units being sold. This non-brokered private placement is subject to TSX Venture Exchange approval. All shares issued pursuant to this offering and any shares issued pursuant to the exercise of warrants will be subject to a four-month hold period from the closing date.

About Juggernaut Exploration Ltd.

Juggernaut Exploration Ltd. is an explorer and generator of precious metals projects in the prolific Golden Triangle of northwestern British Columbia. Its projects are in world-class geological settings and geopolitical safe jurisdictions amenable to Tier 1 mining in Canada. Juggernaut is a member and active supporter of CASERM, an organization representing a collaborative venture between the Colorado School of Mines and Virginia Tech. Juggernaut's key strategic cornerstone shareholder is Crescat Capital.

For more information, please contact

Dan Stuart

President, Director, and Chief Executive Officer

604-559-8028

info@juggernautexploration.com

Qualified Person

Rein Turna P. Geo is the independent qualified person as defined by National Instrument 43-101, for Juggernaut Exploration projects, and supervised the preparation of, and has reviewed and approved, the technical information in this release.

Grab samples are selected samples and may not represent true underlying mineralization.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

FORWARD LOOKING STATEMENT

Certain disclosures in this release may constitute forward-looking statements that are subject to numerous risks and uncertainties relating to Juggernaut's operations that may cause future results to differ materially from those expressed or implied by those forward-looking statements, including its ability to complete the contemplated private placement. Readers are cautioned not to place undue reliance on these statements. NOT FOR DISSEMINATION IN THE UNITED STATES OR TO U.S. PERSONS OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES. THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR AN INVITATION TO PURCHASE ANY SECURITIES DESCRIBED IN IT.

Copyright (c) 2025 TheNewswire - All rights reserved.

News Provided by TheNewsWire via QuoteMedia

Surge in Copper Demand Re-energises Cobar Basin’s Underexplored Resource Potential

The Cobar Basin in central New South Wales, Australia, may be emerging as a key focus for investors positioning for the next wave of copper supply. With a looming global shortage of the red metal and long-term demand being driven by electrification and decarbonisation, savvy investors are turning to proven but underexplored regions like Cobar — home to some of Australia’s highest-grade copper and polymetallic deposits.

Located within a region that holds 12 percent of Australia’s economic demonstrated copper resource, the Cobar Basin is backed by more than a century of mining success, strong infrastructure and modern exploration upside. With such high resource potential, junior explorers are keen to capitalise on the region’s rich copper history and established infrastructure.

Mining legacy and geological setting

The town of Cobar, located in Western New South Wales, is a well-established mining service centre with more than 150 years of production history. Known for its skilled workforce, mining infrastructure and access to road, power and processing facilities, Cobar offers a low-barrier environment for new exploration and development.

The region sits within a stable Australian jurisdiction, with supportive regulatory frameworks and a history of successful permitting and operations — making it an ideal destination for long-term mineral investment.

What sets the Cobar Basin apart geologically is its distinctive structural style and mineral endowment. The Basin hosts a variety of deposit types, most notably “Cobar-style” deposits — steeply dipping, structurally controlled lodes rich in copper, gold, lead, zinc and silver. These lodes often occur in narrow but high-grade zones, making them attractive exploration targets.

Many existing mines in the region — including Aurelia Metals' (ASX:AMI,OTC Pink:AUMTF) Federation mine, Metals Acquisition’s (NYSE:MTAL) CSA mine and Aeris Resources' (ASX:AIS,OTC Pink:ARSRF) Tritton operations — began as small discoveries before developing into large, profitable systems.

Yet, despite its rich production history, the Basin remains underexplored at depth, and much of it has not been subjected to modern geophysics or systematic geochemistry.

This creates a significant opportunity for new discoveries, particularly with the application of advanced tools and reinterpretation of historic datasets.

Mining in the Cobar Basin stretches back to the 1870s, when the discovery of copper and gold led to the town’s founding. Since then, the region has yielded numerous high-grade deposits and produced millions of tonnes of copper, gold and polymetallic concentrates. Key projects that underscore Cobar’s mining credentials include:

- The Federation mine — a high-grade zinc-lead-gold deposit under development.

- Peel Mining’s (ASX:PEX) Mallee Bull and Wirlong projects — advancing toward potential mine development.

- Kingston Resources’ (ASX:KSN) Mineral Hill mine — a polymetallic producer with significant upside.

- The CSA copper mine — one of Australia’s highest-grade copper operations, located just 11 kilometres from the town of Cobar.

- The Tritton mine — a significant copper producer with a long track record of success.

- Polymetals Resources’ (ASX:POL) Endeavor mine — a former zinc-lead-silver producer demonstrating the longevity of Cobar’s deposits.

Together, these operations represent decades of production, resource growth and sustained investment, reinforcing the Basin’s strategic importance in Australia’s mining landscape.

Mount Hope Mining: Positioned for scalable copper-gold discovery

At the forefront of the Cobar Basin’s new exploration wave is Mount Hope Mining (ASX:MHM), a copper-gold explorer with a commanding land position in the southern extension of the Basin, approximately 148 kilometres south of the town of Cobar. With four exploration licences covering 175 square kilometres, the Mount Hope project offers exposure to a richly mineralised corridor that hosts multiple historic copper and gold mines — including the Mount Hope, Comet and Great Central copper mines, and the Mount Solitary and Solar gold prospects.

Mount Hope’s strategy is centred on identifying and advancing Cobar-style mineralisation using modern exploration techniques. The company has already commenced systematic field programs across five high-priority target zones, combining reinterpretation of historical data, geochemical soil sampling and reprocessed airborne geophysical surveys. These efforts are guided by expert technical support from Southern Geoscience Consultants, and are being further refined with the addition of a ground gravity survey initiated in Q1 2025.

Mount Hope’s project area is structurally complex and mineralogically fertile, with known copper and gold occurrences along key shear zones. Yet much of this ground has seen little to no modern exploration, offering significant blue-sky potential at depth – a hallmark of many long-life Cobar Basin deposits.

Following a successful $5 million IPO in December 2024, the company is well funded with $4.5 million in cash at the end of Q1 2025, enabling it to execute its maiden drill program with flexibility and scale.

With copper fundamentals strengthening and investor appetite for Tier 1 jurisdiction discoveries on the rise, Mount Hope Mining presents a compelling exploration investment story grounded in a proven mineral belt, informed by modern science and driven by a clear strategy for growth.

Macro tailwinds: Copper’s critical role in the energy transition

Copper is indispensable to the clean energy transition, with demand set to rise sharply as nations roll out more electric vehicles, renewable power infrastructure and advanced grid systems. The International Energy Agency estimates copper demand could surge over 50 percent by 2040, driven by decarbonisation and electrification initiatives.

Yet the supply pipeline is strained: existing mines are aging, grades are declining and few large-scale discoveries have emerged in recent years. This looming supply gap puts greater strategic value on known but underexplored copper regions, like the Cobar Basin, especially those in low-risk jurisdictions like Australia.

Investor takeaway

For investors seeking copper and gold exposure in a world-class jurisdiction with both geological pedigree and modern exploration upside, the Cobar Basin represents a high-potential opportunity.

And with a well-funded, technically capable team focused on unlocking its southern frontier, Mount Hope Mining is well placed to be a key driver of the next chapter in Cobar’s mining legacy.

This INNspired article is sponsored by Mount Hope Mining (ASX:MHM). This INNspired article provides information which was sourced by the Investing News Network (INN) and approved by Mount Hope Mining in order to help investors learn more about the company. Mount Hope Mining is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNspired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Mount Hope Mining and seek advice from a qualified investment advisor.

Juggernaut Files for Final Approval of Oversubscribed Financing

(TheNewswire)

Vancouver, British Columbia TheNewswire - May 30, 2025 Juggernaut Exploration Ltd. (TSX-V: JUGR) (OTCQB: JUGRF) (FSE: 4JE) (the "Company" or "Juggernaut"), further to its April 14 th April 23 rd April 25 th 2025, and May 15, 2025, news releases, the Company is pleased to announce that it has filed documents with the TSX Venture Exchange (the "Exchange") seeking final approval to close its private placement financing (the "Financing") for aggregate gross proceeds of $10,362,735.

The Company is seeking approval to close the Financing with this second and final tranche, issuing 2,040,000 $0.825 charity flow-through units ("CFT Units"), with each CFT Unit consisting of 1 flow-through common share of the Company and 1 common share purchase warrant, each warrant being exercisable at $0.75 for 5 years, subject to the right of the Company to accelerate the exercise period to 30 days if, after the 4-month hold has expired, shares of the Company close at or above $1.50 for 10 consecutive trading days, for aggregate gross proceeds of $1,683,000.

On May 16, 2025 the Company closed the first tranche of the Financing, issuing 9,308,770 CFT Units, and 2,000,000 $0.50 non-flow-through units ("NFT Units"), each NFT Unit consisting of 1 common share and 1 common share purchase warrant, each warrant being exercisable at $0.75 for 5 years, subject to the right of the Company to accelerate the exercise period to 30 days if, after the 4-month hold has expired, shares of the Company close at or above $1.50 for 10 consecutive trading days, for aggregate gross proceeds of 8,679,735.

The proceeds will be used to explore Juggernaut's properties located in Northwestern B.C. and for general working capital.

Cash finders' fees totaling $221,963 have been paid and 439,925non-transferable broker warrants have been issued in accordance with TSXV Polices. All securities issued in the first tranche closing are subject to a 4-month-plus-one-day hold, expiring September 17, 2025, and all securities issued in the second tranche closing are subject to a 4-month-plus-one-day hold expiring October 2, 2025.

One insider subscribing for 2,000,000 NFT Units, a "related party transaction" as defined under Multilateral Instrument 61-101 ("MI 61-101"), is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101.

About Juggernaut Exploration Ltd.

Juggernaut Exploration Ltd. is an explorer and generator of precious metals projects in the prolific Golden Triangle of northwestern British Columbia. Its projects are in world-class geological settings and geopolitical safe jurisdictions amenable to Tier 1 mining in Canada. Juggernaut is a member and active supporter of CASERM, an organization representing a collaborative venture between the Colorado School of Mines and Virginia Tech. Juggernaut's key strategic cornerstone shareholder is Crescat Capital.

For more information, please contact

Dan Stuart

President, Director, and Chief Executive Officer

604-559-8028

info@juggernautexploration.com

Qualified Person

Rein Turna P. Geo is the independent qualified person as defined by National Instrument 43-101, for Juggernaut Exploration projects, and supervised the preparation of, and has reviewed and approved, the technical information in this release.

Grab samples are selected samples and may not represent true underlying mineralization.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

FORWARD LOOKING STATEMENT

Certain disclosures in this release may constitute forward-looking statements that are subject to numerous risks and uncertainties relating to Juggernaut's operations that may cause future results to differ materially from those expressed or implied by those forward-looking statements, including its ability to complete the contemplated private placement. Readers are cautioned not to place undue reliance on these statements. NOT FOR DISSEMINATION IN THE UNITED STATES OR TO U.S. PERSONS OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES. THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR AN INVITATION TO PURCHASE ANY SECURITIES DESCRIBED IN IT.

Copyright (c) 2025 TheNewswire - All rights reserved.

News Provided by TheNewsWire via QuoteMedia

Harmony Gold to Acquire MAC Copper in US$1.03 Billion Deal

Harmony Gold Mining Company's (NYSE:HMY,JSE:HAR) wholly owned Australian subsidiary, Harmony Gold (Australia), has entered into a binding agreement to acquire MAC Copper (NYSE:MTAL,ASX:MAC).

MAC is the owner of the CSA copper mine in New South Wales. Its annual production comes to approximately 40,000 metric tons of copper, with 2024 output totaling 41,000 metric tons of the red metal.

The transaction is priced at US$12.12 per MAC share in cash, implying a total equity value of US$1.03 billion for MAC.

“(This acquisition) is significant as it introduces a high-quality, established underground producing copper asset to the Harmony portfolio,” said Harmony Gold CEO Beyers Nel in a Tuesday (May 27) press release.

“The operation is a logical fit with the portfolio given it meets Harmony’s core investment criteria, including increasing free cash flow generation while improving margins at long-term expected commodity prices.”

Located 700 kilometers west-northwest of Sydney in the Cobar region, CSA has a history that stretches back at least 150 years. Its reserve life stands at over 12 years, and it has maintained a stable resource over the last decade.

Harmony believes CSA will be a valuable addition to its sole Australian asset, Eva, in Northwest Queensland. Harmony acquired Eva in December 2022, and believes it is set to become the state's biggest copper mine.

According to the company, Eva and CSA could together boost its copper production on the east coast of Australia to 100,000 metric tons annually over the course of the next five years.

The transaction remains subject to certain conditions, but MAC’s board has unanimously recommended that shareholders vote in favor of the scheme. Should everything follow to schedule, the deal is expected to close in Q4.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

Ivanhoe, Zijin Halt Operations at Kakula Copper Mine in DRC

Operations at Ivanhoe Mines' (TSX:IVN,OTCQX:IVPAF) Kakula mine in the Democratic Republic of the Congo (DRC) remain suspended after seismic activity was reported at the site.

Ivanhoe initially disclosed the interruption on May 20, when seismic activity was first detected, but extended the temporary shutdown on Monday (May 26) following several days of ongoing seismic events.

Employees working in the mine have been safely brought above ground, and mobile equipment has been removed.

Ivanhoe indicated that tremors are expected to continue for several weeks, and it could be some time before work crews will be allowed back on site. The shutdown has also impacted underground pumping and electrical infrastructure, resulting in an increase in water inflow to the underground mine, which will further affect the restart timeline.

The company notes that a dewatering plan using additional pumping equipment is in development.

Ivanhoe founder and Executive Co-Chairman, Robert Friedland, focused on positive takeaways from the shutdown.

“What has transpired will give us valuable insight into managing geotechnical conditions and maintaining critical pumping infrastructure, which will allow us to future-proof and safely restart mining operations,” he said.

The mine is part of the larger Kamoa-Kakula copper complex, a 40/40/20 joint venture between Ivanhoe Mines, China’s Zijin Mining Group (OTC Pink:ZIJMF,HKEX:2899) and the DRC government. The complex is one of the world's largest copper-mining operations, with average annual output of 1.09 billion pounds of copper concentrate.

While Ivanhoe and Zijin are working together to reopen the mine, the two companies have been at odds over the severity of the seismic activity. On May 23, Zijin said seismic activity had resulted in “multiple roof-falling and rib-spalling in the eastern section of the mine." In a rebuttal released the same day, Ivanhoe said seismic activity had caused a redistribution of forces underground, resulting in “'scaling,' or rockfalls, from the sidewalls of certain mining areas.”

The neighboring Kamoa mine and its Phase 3 concentrator will continue to operate as normal. Phase 1 and 2 concentrators, which service the Kakula mine, will also continue to operate from supplies from stockpiled material.

Ivanhoe said the suspension of operations has forced the company to withdraw its production and cost guidance for 2025, which had been set at 520,000 to 580,000 metric tons of copper.

Shares of Ivanhoe slumped 17 percent, sinking from C$12.85 to C$10.66, following the company's Monday announcement. As of Wednesday (May 28) morning, shares were priced at C$11.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Finlay Minerals Announces Non-Brokered Private Placement of Flow-Through Shares and Non-Flow-Through Units

/NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES/

finlay minerals ltd. (TSXV: FYL) (OTCQB: FYMNF ) ("Finlay" or the "Company") is pleased to announce that it intends to complete a non-brokered private placement (the " Private Placement ") consisting of the issuance of any combination of: (i) common shares of the Company to be issued on a flow-through basis under the Income Tax Act ( Canada ) (each, a " FT Share ") at a price of $0.11 per FT Share, and (ii) non-flow-through units of the Company (each, a " NFT Unit ") at a price of $0.10 per NFT Unit, for aggregate gross proceeds to the Company of up to $1,000,000 . The Private Placement is subject to a minimum offering amount of $500,000 to be raised through any combination of FT Shares and NFT Units.

Each NFT Unit will be comprised of one non-flow-through common share of the Company (each, a " NFT Share ") and one non-flow-through common share purchase warrant (a " Warrant "). Each Warrant will be exercisable by the holder thereof to acquire one NFT Share at an exercise price of $0.20 per NFT Share for a period of two years from the date of issuance of the Warrant (the " Warrant Expiry Date "), subject to acceleration. The Warrant Expiry Date may, at the Company's sole discretion, be accelerated if at any time following the Closing Date (as defined herein), the common shares of the Company trade at a daily volume-weighted average trading price above $0.30 per common share for a period of 30 consecutive trading days on the TSX Venture Exchange (the " TSXV ") or on such other stock exchange where the majority of the trading occurs (the " Trading Target ") and the Company provides notice to the Warrant holders by way of press release announcing that such Trading Target has been achieved, provided that the accelerated expiry date of the Warrants falls on the earlier of (unless exercised by the holder prior to such date) (the " Accelerated Expiry Date "): (i) the 30th day after the Company provides notice to the Warrant holders of its intention to accelerate the Warrant Expiry Date; and (ii) the Warrant Expiry Date. The failure of the Company to give notice in respect of a Trading Target will not preclude the Company from giving notice of any subsequent Trading Target. All Warrants that remain unexercised following the Accelerated Expiry Date shall immediately expire and all rights of holders of such Warrants shall be terminated without any compensation to such holders.

The Company intends to use the gross proceeds of the Private Placement for exploration of the Company's SAY, JJB and Silver Hope properties, and for general working capital purposes. The Company will use the gross proceeds from the issuance of FT Shares to incur "Canadian exploration expenses" and qualify as "flow-through mining expenditures", as such terms are defined in the Income Tax Act ( Canada ).

Subject to compliance with applicable regulatory requirements, the Private Placement is being conducted pursuant to the listed issuer financing exemption under Part 5A of National Instrument 45-106 – Prospectus Exemptions and in reliance on the Coordinated Blanket Order 45-935 – Exemptions from Certain Conditions of the Listed Issuer Financing Exemption . The securities issued to purchasers in the Private Placement will not be subject to a hold period under applicable Canadian securities laws. There is an offering document related to the Private Placement that can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at www.finlayminerals.com . Prospective investors should read this offering document before making an investment decision.

The closing of the Private Placement is expected to occur on or about June 9, 2025 (the " Closing Date "). The closing of the Private Placement is subject to certain closing conditions, including the approval of the TSXV. The Company may pay finder's fees in cash and securities to certain arm's length finders engaged in connection with the Private Placement, subject to the approval of the TSXV.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been registered under the United States Securities Act of 1933 , as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements thereunder.

About finlay minerals ltd.

Finlay is a TSXV company focused on exploration for base and precious metal deposits through the advancement of its ATTY, PIL, JJB, SAY and Silver Hope Properties; these properties host copper-gold porphyry and gold-silver epithermal targets within different porphyry districts of northern and central BC. Each property is located in areas of recent development and porphyry discoveries with the advantage of hosting the potential for new discoveries.

Finlay trades under the symbol "FYL" on the TSXV and under the symbol "FYMNF" on the OTCQB. For further information and details, please visit the Company's website at www.finlayminerals.com

On behalf of the Board of Directors,

Robert F. Brown ,

Executive Chairman of the Board & Director

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information: This news release includes certain "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements in this news release include statements regarding, among others, the terms and completion of the Private Placement, raising the minimum and maximum amounts of the Private Placement, the payment of finder's fees and issuance of finder's securities, the anticipated closing date and the planned use of proceeds for the Private Placement. Although Finlay believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include the ability to obtain regulatory approval for the Private Placement, the state of equity markets in Canada and other jurisdictions, market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. These forward-looking statements are based on a number of assumptions including, among other things, assumptions regarding general business and economic conditions, the timing and receipt of regulatory and governmental approvals, the ability of Finlay and other parties to satisfy stock exchange and other regulatory requirements in a timely manner, the availability of financing for Finlay's proposed transactions and programs on reasonable terms, and the ability of third-party service providers to deliver services in a timely manner. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements, and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Finlay does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future or otherwise, except as required by applicable law.

SOURCE finlay minerals ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2025/26/c7629.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2025/26/c7629.html

News Provided by Canada Newswire via QuoteMedia

Latest News

Empire Metals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.