NEW YORK: The S&P 500 and Nasdaq edged higher on Thursday as Oracle’s results boosted optimism around artificial intelligence, offsetting concerns around rising tensions in the Middle East and a drop in Boeing shares.

Oracle shares shot up nearly 14% to record highs after the cloud service provider raised its annual revenue growth forecast, driven by strong demand for its AI-related cloud services.

Boeing declined 5% after an Air India 787-8 Dreamliner jet crashed minutes after taking off in India’s western city of Ahmedabad, killing more than 200 people.

“I think it will be important to see whether the findings point to a problem with maintenance rather than a problem with the original equipment,” said Sam Stovall, chief investment strategist at CFRA Research.

Signs of rising tensions in the Middle East also weighed on global markets.

President Donald Trump said on Wednesday US personnel were being moved out of the region as it could be a “dangerous place” and the United States would not allow Iran to have a nuclear weapon. Officials from both countries are scheduled to meet in Oman on Sunday for a sixth round of nuclear talks.

A senior Iranian official said on Wednesday Tehran will strike US bases in the region if nuclear negotiations fail and conflict arises.

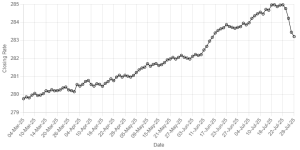

At 11:40 a.m. ET, the Dow Jones Industrial Average fell 49.67 points, or 0.12%, to 42,816.10, the S&P 500 gained 8.65 points, or 0.14%, to 6,030.89 and the Nasdaq Composite gained 18.95 points, or 0.10%, to 19,634.83.

Seven of the 11 major S&P 500 sub-sectors rose, led by information technology stocks with a 0.8% rise.

Shares of Nvidia, Broadcom and Super Micro Computers rose more than 1% each.

US-listed shares of gold miners also advanced, as bullion prices hit a one-week high. Newmont gained 3.5%, Harmony Gold was up 3.7% and AngloGold Ashanti rose 5.6%.

Softer-than-expected producer price data and initial jobless claims numbers pointing to a potential weakening in the labor market helped reduce investor jitters around tariff-driven price pressures and boosted rate cut bets.

Traders are pricing in 53.7 basis points of rate cuts by year-end, per data compiled by LSEG. They are penciling in a near 60% chance of a 25 bps cut in September, according to the CME Group’s FedWatch tool.

Policymakers are widely expected to keep rates unchanged next week.

The S&P 500 posted 8 new 52-week highs and 3 new lows while the Nasdaq Composite recorded 38 new highs and 48 new lows.

Comments

Comments are closed.