Gold prices edged higher on Monday, following headlines related to Saudi Arabia, before retreating somewhat on Tuesday. Besides arresting dozens of its own public figures on charges of corruption over the weekend, the Kingdom indicated on Monday that Lebanon had declared war against it, and that a missile fired at its capital from Yemen recently was an “act of war” by Iran. These signals of rapidly rising geopolitical tensions in the region likely caught markets by surprise, pushing oil prices higher on the increased risk of supply disruptions, and triggering safe haven flows into gold. Given the absence of any major events on the US economic calendar to affect the greenback in a significant manner this week, we think that this story will likely be the main driver of gold prices over the next days at least.

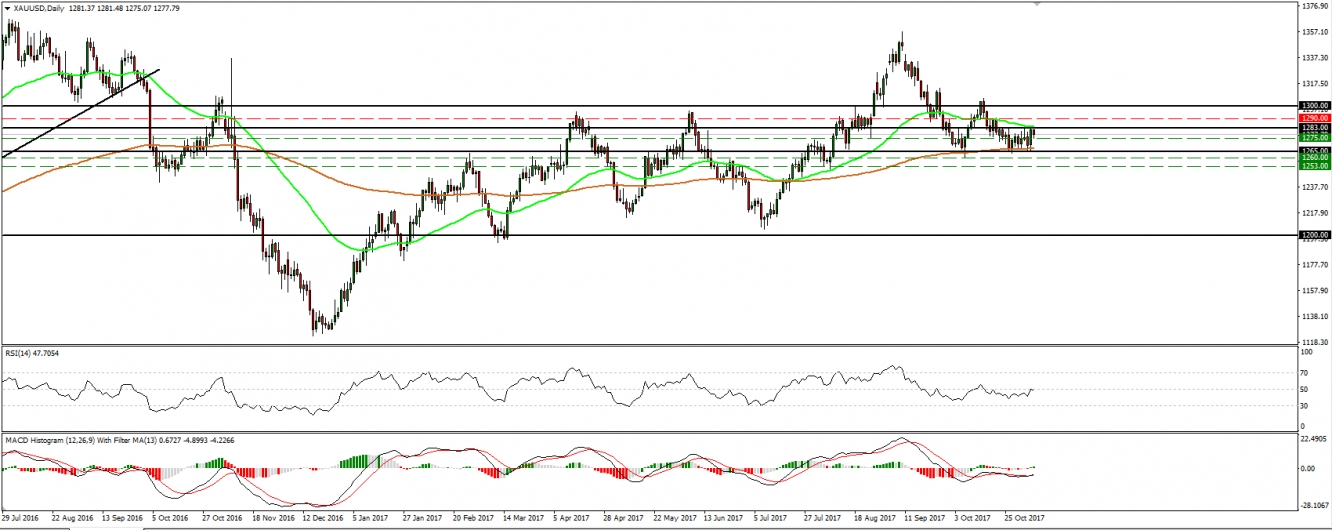

Gold traded higher on Monday, but hit resistance once again at 1283 (R1) and on Tuesday it retreated somewhat. The precious metal has been oscillating between that resistance and the support zone of 1265 (S2) since the 20th of October and thus, we consider the short-term outlook to be flat for now. Having said that though, given that the latest retreat came after the price tested the upper bound of the aforementioned range, we see the case for the bears to remain in the driver’s seat for a while, at least in the absence of any escalation in geopolitical tensions. At the time of writing, gold is testing the 1275 (S1) support line, where a decisive dip may open the way for the lower bound of the range, at 1265 (S2).

Taking a look at our short-term oscillators, we see that both the RSI and the MACD have been oscillating around their equilibrium levels, confirming the trendless short-term outlook. However, the RSI slid and now looks ready to fall below its 50 line, while the MACD shows signs of topping and that it could turn negative again soon. These signs enhance our view that the yellow metal may trade a bit lower, at least within the short-term sideways range.

Switching to the daily chart, we see that the metal continues to trade within the wide sideways range between the psychological zones of 1300 (R3) and 1200. In our view, this keeps the broader outlook flat as well.